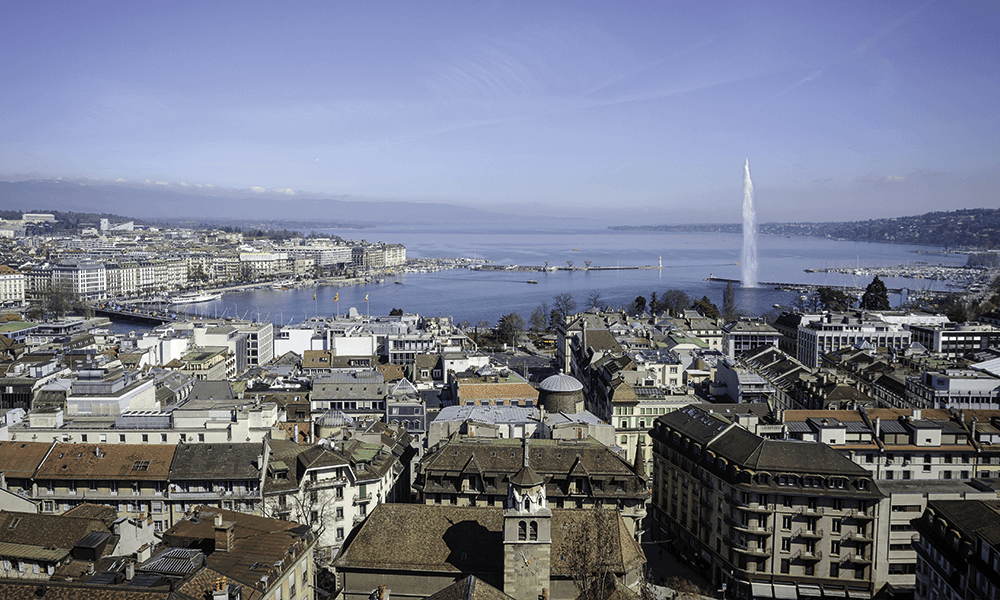

TCA Asset Management is a specialised investment boutique, established in Geneva during 2011. Managing Director Ludovic Bonnamour discusses the firm’s work, following their success in achieving the accolade of the Most Outstanding Investment Advisory Firm – Switzerland, as part of the Fund Manager Elite 2017 series.

TCA Asset Management is an innovative alternative boutique asset management firm. Established in Geneva in 2011, it is a fast-growing company, currently providing four complimentary activities: wealth management; corporate finance; family office and fund support services.

The firm was established to bear in mind any forthcoming regulatory changes and evolving client needs over the long term (i.e. greater efficiency, higher service levels, global banking and choice of services). The business was structured from a risk management perspective, rather than the usual business model adopted by EAMs of just pooling assets. This model brings a long-term perspective for both internal and external clients, enabling the company to grow continuously.

Ludovic Bonnamour is the managing director and partner of TCA Asset Management, a Swiss-based advisory boutique specialising in fund support services, wealth management and corporate finance. In his own words, Ludovic tells us more about his own role in the firm.

My role is to build and to develop the company as an overall (from the business activities to the CFO duties), so I am involved in global management and business development when assisting the team and our specialists in the day to day business for servicing clients.

“I have worked 14 years in finance and be able to acquire skills and knowledge from international companies such as Allianz and HSBC in several functions from risk management to advisory services, and alongside internal and external clients in retail banking, private banking and corporate banking activities. Specialising in alternative investments as well as in quantitative fields, I worked in the hedge funds industry, credit advisory, portfolio leverage analysis, Basel regulatory capital requirements and lending activities, while liaising with group offices before developing new services from TCA Asset Management since 2011.”

Opportunities and challenges for the industry The firms in Switzerland and abroad recently recovered from the global heavy consecutive financial crisis of the last ten years, that impacted not only the financial markets, but also the real economy Ludovic highlights.

“That highlighted clear shifts in strategy for lots of countries, governments and companies, working on new kind of technologies, new types of income streams while sometimes venturing into completely new approaches” he went on to say.

“Switzerland is now for a while, very well recognised for its manufacturing industry, for the chemical and pharmaceutical industry, as well as for its knowhow in terms of financial centre. Switzerland is for a long time recognised for its stability, universality, responsibility and excellence with proven methods and reliability” Ludovic continues.

First Triggered by the 2008/2009 crisis and the subsequent sovereign debt crisis, the last five years have had an impact on the local financial market environment in Switzerland and its wealth management industry Ludovic believes. This includes solving the problems of the past with taxation and transparency, adopting international standards, bringing market access in the EU and compatibility of products and improving the competitiveness framework conditions.

“The authority started to strengthen professionalism and regulatory requirements for managing financial assets and financial companies. At the same time, due to higher costs, sometimes decrease of profitability or even legal constraints, banks merged or closed, therefore the number of actors continuously decreased by more than 20% over the last twelve years (338 in 2004 and 266 in 2015 – source SNB).

“The private banking industry in Switzerland (in numbers) is today represented by 266 institutions and more than 2400 independent firms (from 1 to 15 employees), so that is nearly 90% of the financial actors. Independent actors so called ‘External Asset Managers’ (EAMs) manage clients’ assets through banks (custody and brokerage services) with a portfolio management approach based on an advisory or a discretionary mandate on behalf of clients.

“Nowadays, CHF 6567 billion are managed in Switzerland through banks – 50% of these assets are originated from abroad (recognised expertise by the international clients) – and this corresponds to a market share of 25.0% of the global cross-border asset management business placing Switzerland n°1.” (source SwissBanking.org)

Having worked in the field for more than 14 years, created an EAM multi boutique asset management firm, developed a cross selling approach with four activities, developed a large network of partners, banks, investors and clients in Switzerland and abroad, Ludovic can attest of a real need of services and a real opportunity to gather market shares.

“A good part of EAMs are now too small for being able to survive (1 to 3 people), offer only one expertise (portfolio management without advisory services or CIO), express difficulties in bringing transparent solutions and value added to their clients.

On top of all this, a vast majority of these actors are turning or have turned 55/65 years old and therefore do not want to build new teams and services. These investment boutiques cannot afford to hire senior investment specialists dedicated to macro research and products. They finally must pay external services such as our “CIO Office Solution” for getting access to a professional advisory and investment committee services”

“Surprisingly, each crisis has helped our firm to increase both its reputation and simultaneously its revenues. Due to a lack of credit in the market following the credit crunch, and based on the team expertise -we have developed an offer around corporate needs that has met people’s needs, the Bernie Maddoff story helped us to develop the fund support activities due to a need of transparency, a third-party monitoring and credibility from a recognised external team.”

“Moreover, the private banks themselves are indirectly helping us to develop businesses through their changing employment policies (reduced job security, constantly increasing pressure and decreasing rewards) and also their approach towards their clients (arbitrarily closing bank accounts of smaller clients in order to manage fewer relationships). We now talk about externalisation and independency from banks.”

Ludovic concludes that clients are more and more comparing services, looking for fee transparency, alignment of interests and open architecture while talking about investments and custodians. Our company has evolved since its inception in 2011 and developed several complimentary activities that led to several well-deserved awards and recognitions from peers based on this long-term approach.

Company: TCA Asset Management

Name: Ludovic Bonnamour – Managing Director

Email: [email protected]

Web Address: www.tca-am.com

Address : Rue du Port 8/10, 1204 Geneva, Switzerland

Telephone: +41 (0)22 566 5250