Did you know that every year, £190bn of Brits’ money is lost to fraud – a figure which is a little less than both the health and defence budgets combined? Unfortunately, it gets much worse – an investigation by price comparison experts, Money Guru, have revealed that almost three quarters (72%)of Brits have fallen victim to scamming techniques at some point.

In order to help raise awareness of this growing problem, they have created the ultimate guide to spotting and stopping scams.

30% of Brits Duped into Authorising Access to Their Bank Account – With No Legal Protection

Although we live in an increasingly digital world, you may be surprised to discover that a lot of fraud actually happens face-to-face, over the phone or through postal services. Smart scammers have begun ticking people into handing over crucial details and access to accounts through this method otherwise known as Authorised Push Payments (APP). Out of the £500m lost in the first half of 2018, 30% (£145m) of that was lost through APP.

What’s worse is that currently, people subject to this kind of scam have no legal protection to cover. Under current regulations, if your bank has not taken enough action – such as not reimbursing you or by not responding – then you have no right to complain or escalate your complaints to any authority.

72% of Brits Were Scammed Over a Two-year Period

Scamming is something that can happen to any of us – and it does, on a regular basis. A report from Citizens Advice revealed that 3 out of 4 of us (72%) were scammed over a two-year period between 2015-2017. Even if you haven’t personally been scammed, chances are you’ll know someone who has 1 in 10 reported knowing someone who has been a victim of fraud.

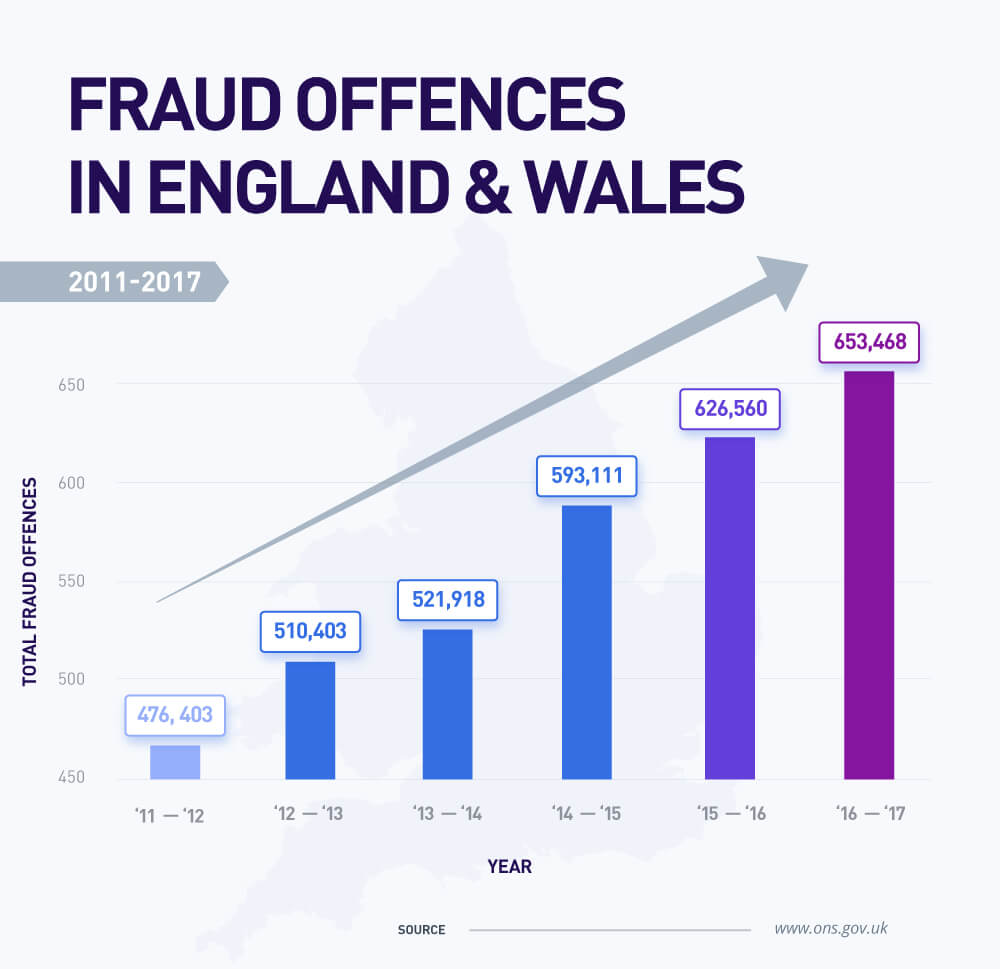

Almost Half (44%) of Fraud Victims Do Not Receive a Full Reimbursement

Research from the Office for National Statistics has revealed that a little less than half of those who were a victim of fraud received no or a partial refund. As you can see from the graph below, the majority of reported losses are under £250 (62%) but almost a quarter of Brits (22%) have been scammed out of £500 or more.

39% of Brits are Targeted by Scammers for Oversharing on Social Media

There’s a certain stereotype that fraud is only something that happens to the older generation. Whilst this is partially true – 5 million people over the age of 65 believe they have been targeted by scammers – they are not the only target demographic.

Scammers have begun targeting those who are active on social media. In fact, 39% of Brits are targeted due to oversharing their highlights online. In addition, 51% of us store e-receipts on our phone which again are targeted by scammers due to holding sensitive information.

Top 10 Scams to Be Aware Of

- Rogue traders and bogus callers – getting you to set up an account for a catalogue.

- Scams by telephone, letter or email – a fraudster pretending to be your bank or telephone provider, and asking you to share your details.

- Pensions – offering unsolicited advice, a pension review or an investment opportunity.

- Money mules – someone attempting to use your account to launder funds, whilst promising a fee in return.

- Copycat websites – charging a fee to review or process official documents, or selling items that aren’t really for sale.

- Tech support – being told your computer has a virus and that it can be fixed – for a fee.

- Employment scams – paying for training courses that don’t exist.

- Auction sites – buying goods that don’t exist, through auction sites or asking you to pay through a bank transfer.

- Ticket scams – selling a fake ticket on an illegitimate site, which unfortunately can’t be refunded.

- Phishing – receiving a text or email asking you to log into your account, which will then reveal your password to cybercriminals

How to Avoid a Scam

- Never give away your personal details such as passwords and bank account numbers. Legitimate companies will never ask for these.

- Never let a stranger into your home.

- Never download attachments or files from an email pr click any links within an email.

- Never directly transfer money to someone unless you trust them 100% and always keep track of your transactions.