Navigate the Latest in Finance and Investment with Wealth & Finance International.

We are dedicated to providing fund managers and institutional and private investors around the world with the latest industry news across both traditional and alternative investment sectors.

We are dedicated to recognising excellence across the globe. View all our awards here.

When it comes to the insurance payments leaving your account, things can get out of hand fast. Having multiple policies in place, like homeowners or renters insurance, pet insurance, life insurance, and auto insurance, can make keeping track of your payments a challenge - and missing one is dangerously easy to do.

In a difficult real estate situation, sound financial management is the cornerstone of sustainable growth and prosperity.

In the relentless battle against cyber threats, the rise of cyber threats presents an ever-growing challenge for individuals and organisations.

In 2023, it is estimated around €2.3 billion was lost by investors to scams, rug pulls, and hacks. Although the technology is becoming more secure and stable, and many users are more aware of the tricks used to steal assets, there are still ways for thieves to extract your crypto if you aren’t careful.

Image: pexels Are your savings working as hard for you as you do for them? In an era where economic certainty feels like a relic, fortifying your finances demands more than just stashing cash away. It’s about strategic moves and a resilient mindset. Consider this: simply opening a high-yield savings account may revolutionize how your […]

Why is Automation a Game Changer in Financial Advisory? Financial advisory plays a key role in managing personal and business finances, offering guidance on investments, retirement planning, and tax strategies. Traditionally, it has been a manual process involving lots of paperwork and in-person meetings. However, technological advancements have introduced automation to the financial advisory sector. […]

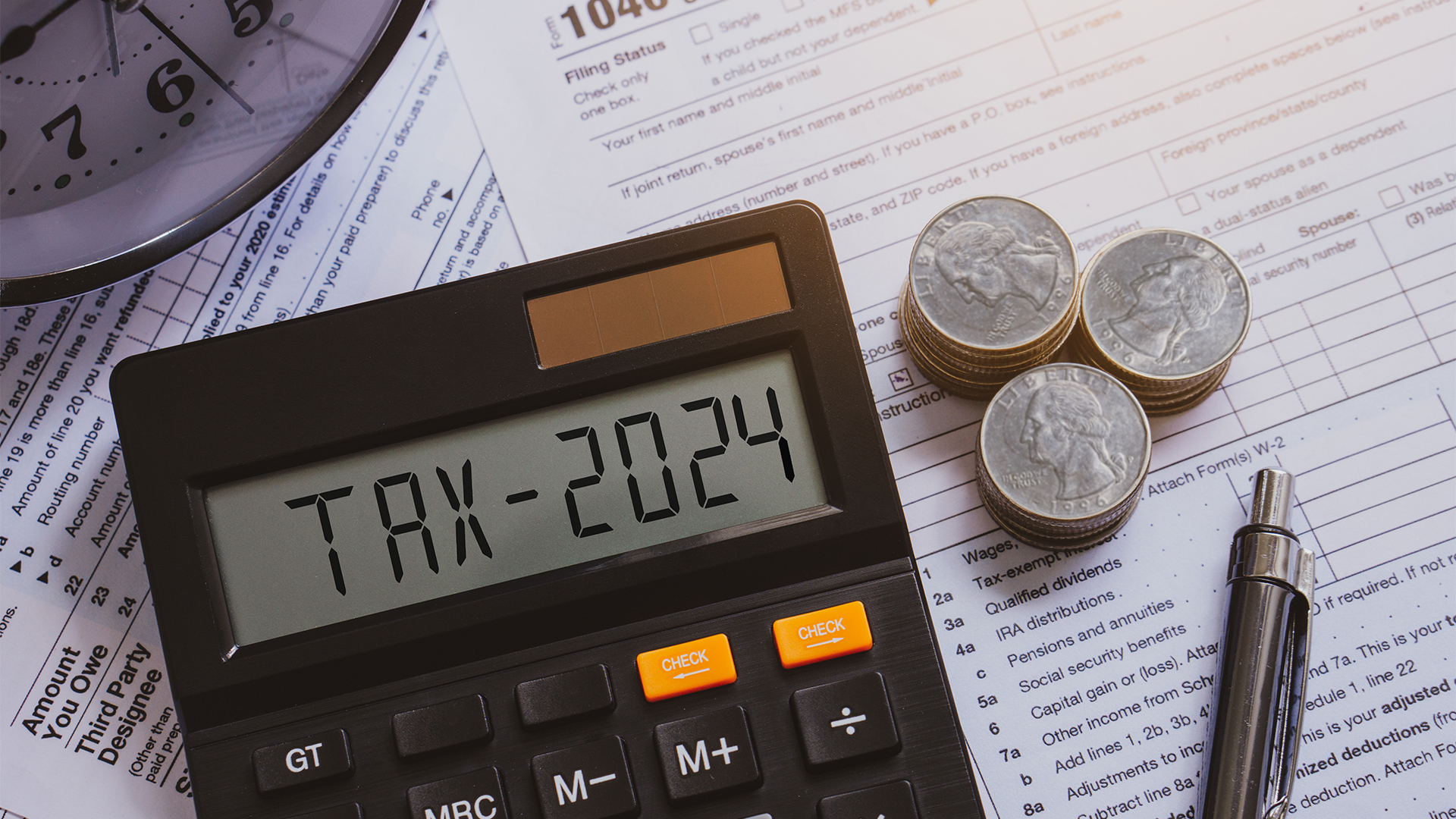

As an entrepreneur, navigating taxes can feel like traversing a complex labyrinth of rules, regulations, and potential pitfalls. However, with the right knowledge and strategies in place, you can not only minimize your tax liability but also safeguard your personal finances for long-term success. In this comprehensive guide, we’ll explore practical tips and insights to […]

Handling finances can be complicated, and it’s something that most people have difficulty with at some point in their lives. In fact, many people find themselves with more questions than solutions on how to manage their money and achieve financial stability.

Next week is Debt Awareness Week (18 - 24 March). While debt is often portrayed in a negative light and seeking help can be daunting, it is essential to understand that debt can be a valuable financial tool if handled with care.

2023 proved a challenging 12 months for the climate vertical, with private equity and grant funding for climate tech startups falling by over 40% compared to the previous year. However, in 2024 investment levels are set to increase, as accumulated public and private capital gets deployed and government support across various sectors ramps up.

After more than two and a half years of struggling with high inflation, financial analysts are urging Americans to make building a solid nest egg of savings their top New Year’s resolution. The prolonged period of high inflation has created severe financial stress for most U.S. households, as they are forced to pay more for everyday needs like food and housing. Low-income households have been particularly hard hit.

As the payments market continues to digitise, consumers are demanding streamlined real-time interactions with banks to remove friction whilst delivering personalised experiences anytime, anywhere and through any device.

When it comes to financing personal expenses, personal loans can be a viable option. Jackson and Marlboro are two cities that offer personal loans, and in this article, we will explore the process of applying for a personal loan in these locations.

As we’re preparing to deal with an 11.1% inflation as of October 2022, people are looking for ways to secure their money and capitalise on their assets.

According to Statista, a record 22,305 businesses will go bankrupt by the end of 2022 in the UK, second only to France’s 22,305.

Cryptocurrencies have taken over the world of consumer and professional finance over the last several years, but how do they actually work? It's probably best to think of cryptocurrencies as digital assets that are secured by cryptography.

In the ever-evolving world of trading technologies, one term has risen to prominence, leaving an indelible mark on the financial landscape: tokenization.

International payments power the global economy, but for many businesses cross-border transactions are still in need of modernisation. Laurent Descout, Founder and CEO of Neo, looks at the progress that has been made so far and the solutions that can drive payment innovation further.

Criminals successfully stole over half a billion pounds over a period of just six months in 2023 through fraud, according to new research from UK Finance.

Armed with the capabilities of machine learning (ML), financial institutions and finance executives have long been turning unstructured information into insights that promote better decision-making and help them understand many key elements of the business.

An all-new, intuitive trading offering is now live. Tradu is the innovative platform that gives traders and investors enhanced access to the essential tools and assets that establish and grow a trading portfolio.

Artificial intelligence (AI) is everywhere you look, and the financial services sector is no different. Banks and other financial firms like hedge funds were some of the first institutions to adopt artificial intelligence at a corporate level, while new technological advances and applications mean that AI usage is more widespread than ever.

Sadly, cybercriminals don’t take breaks over Christmas. In fact, with so many more financial transactions taking place over the festive season, it’s a prime opportunity for cybercriminals to take advantage of poor cybersecurity. The Christmas season is a perfect background for a cybercriminal to attack, so what are the most common ways that you could be caught out this festive season?

In a difficult real estate situation, sound financial management is the cornerstone of sustainable growth and prosperity.

Handling finances can be complicated, and it’s something that most people have difficulty with at some point in their lives. In fact, many people find themselves with more questions than solutions on how to manage their money and achieve financial stability.

In light of the recent surge in gold prices, many investors are turning their attention to the tangible allure of physical gold as a cornerstone of their investment portfolios.

Embedded finance may seem like a complex or new concept, but actually, we have been using it for over a decade.

Concerns over pay within the NHS continue to grow with this past January marking the longest strike period in NHS history: a stretch of six consecutive days.

Your investment pitch is like a short yet effective talk where you tell folks why it’s most advantageous for them to invest in your business or idea.

Businesses of all types and sizes are now benefiting from cloud accounting, which has been around since the early 2010s. But what do we mean by cloud accounting?

Crafting attractive retirement packages for your team is crucial, especially in today’s competitive job market. These benefits not only serve as a token of appreciation for years of service but also play a significant role in attracting and retaining top talent.

Almost one third (30%) of UK business owners plan to sell their businesses to help fund their retirement, according to new research.

Although conditions are challenging for new business ventures this year with factors such as the pandemic and cost of living crisis playing a part, all hope is not lost.

Growing a business in the current economic climate is a challenge. With rising costs slashing profit margins and prohibiting growth, external investment has become almost a necessity for small and medium-sized enterprises (SMEs) to expand.

With the new tax year having just commenced, it’s a good time to review outstanding debts and take proactive steps to try and minimise or limit your business’s exposure to them. This is particularly the case given financial uncertainty in the market coupled with the ever-growing cost of living crisis, increasing costs throughout the supply chain and the consistent rise in registered company insolvencies since the pandemic.

In today’s business climate, there’s no denying the importance of sustainable operating practices. Operating sustainably has plenty of tangible benefits for businesses – aside from a clean conscience of course. Increased profitability and desirability as an employer are just two of the advantages that can be gleaned from sustainable business.

Globant, a digitally native company focused on reinventing businesses through innovative technology solutions, announced today that its Be Kind Tech Fund has invested $1 million in Polemix, the first platform to introduce Web3 technology to the world of ideas and opinions. The startup's mission is to upgrade how people support and oppose opinion leaders, disrupting the echo chambers cultivated by traditional social media platforms.

AEI Capital is passionate about dealing with the capitalization of corporate vision. It knows that anything is possible with the correct strategy alongside a smart capitalization model and a knowledgeable blueprint for the most effective, essential parts of the Private Equity industry.

Figures out from HMRC this morning show that the Treasury raked in another £4.1billion in inheritance tax receipts in the months between April and October 2022. This is £500 million more than in the same period a year earlier, continuing the upward trend. These figures are revealed just days after the Autumn Statement in which it was announced that the inheritance tax threshold of £325,000 will be frozen until April 2028.

In these times of uncertainties with the growing number of geopolitical tensions, worldwide conflicts as well as other variables influencing the global markets, investors are turning to assets that provide a stability and resilience to these global influences. Among these assets, gold has long been hailed as one of the safe havens with an outstanding reputation for holding its value even through the economic upheavals caused through conflicts and worldwide politics, in this article we take a look at whether gold is truly ‘war proof.’

By Francesca Rayneau, Director at Calculus Enterprise Investment Schemes (EISs) are a powerful way for clients, who are comfortable with the risks, to target high growth investments. For a company to qualify for EIS funding it must be early stage and not listed on the main market of the London Stock Exchange. These companies often […]

Institutional investors have been increasing allocations to illiquid assets and Downing’s research suggests the trend is set to continue. In this market outlook, Kostas Manolis, Partner and Head of Private Market Investments, explains why the current economic conditions make illiquid assets attractive.

Durham-based company Anglo Scottish Asset Finance Ltd is excited to announce the completion of a management buyout (MBO) to take back control of the business.

Saxo Bank, the leader in online trading and investment, today announced its annual Outrageous Predictions for 2024. The predictions focus on a series of unlikely but underappreciated events which, if they were to occur, would send shockwaves across the financial markets.

Looking for a new avenue to invest in for 2024? Most people looking to invest in property are immediately drawn to residential projects – those looking to invest are typically homeowners and want to stick to what they know.

A recent report from the Royal United Services Institute (RUSI) has called for greater cooperation between government bodies, insurers, and cyber security specialists to establish best practice guidelines on dealing with cyber-attacks and ransomware.

Predicting the ebb and flow of the global financial markets can often be likened to gazing into a crystal ball. This outlook becomes even more opaque when climate change impacts are thrown into the mix. One possible future, however, is that the climate transition’s reshaping of the global economy may trigger a global financial crisis.

When it comes to the insurance payments leaving your account, things can get out of hand fast. Having multiple policies in place, like homeowners or renters insurance, pet insurance, life insurance, and auto insurance, can make keeping track of your payments a challenge - and missing one is dangerously easy to do.

In 2023, it is estimated around €2.3 billion was lost by investors to scams, rug pulls, and hacks. Although the technology is becoming more secure and stable, and many users are more aware of the tricks used to steal assets, there are still ways for thieves to extract your crypto if you aren’t careful.

Concerns over pay within the NHS continue to grow with this past January marking the longest strike period in NHS history: a stretch of six consecutive days.

Amidst the cost-of-living crisis, higher education students are increasingly seeking ways to support their exciting university life with additional income.

The U.S. personal savings rate fell to 4.1% in November from 4.2% in August and 5.3% in May. Beyond the monthly data, personal savings have garnered substantial interest from global investors. Many are concerned that once savings run out, U.S. consumers will wilt, and so will the U.S. economy. However, investors' misconceptions about personal savings may cause them to overstate consumer health concerns.

With the rising cost of living in the UK, many consumers are keeping regular tabs on their spending and looking for ways to cut costs when taking care of and maintaining their homes.

Being self-employed shouldn’t automatically mean securing a mortgage will be a challenge. With over 4.2 million British workers now classified as self-employed1 – and expectations the sector will only continue to grow - it is more important than ever before to know just what extra considerations are needed to secure a mortgage.

This year Tax Freedom Day falls on Thursday 8th June. This is the day of the year by which, theoretically, the average UK taxpayer will have earned enough to pay all of their taxes for that year. This includes tax on all income, as well as the purchase of all goods and services.

The UK tax year, often referred to as the financial year, starts on the 6th April and ends on the 5th April the following year. The end of the tax year is an important deadline for all taxpayers, marking the cutoff for various tax-related relief, payments, and actions.

Investors navigating the complex landscape of wealth management often seek avenues that not only offer lucrative returns but also come with attractive tax benefits. Venture Capital Trusts (VCTs) and Enterprise Investment Schemes (EISs) emerge as compelling options, intertwining attractive tax benefits with portfolio diversification. In this piece, we'll delve into the intricacies of these investment vehicles, shedding light on their structures, benefits, and potential risks.

From April 2024, changes to R&D tax relief announced in the 2023 Budget mean that the existing R&D Expenditure Credit (RDEC) and the SME R&D schemes will be merged into a new simplified R&D tax relief incentive.

Significant changes are on the horizon for IR35, set to take effect on April 6th. This new policy, known as ‘IR35 offset’, aims to prevent double taxation by empowering HMRC to offset tax and NI contributions already paid by contractors, fostering fairer sharing of tax liabilities throughout the supply chain.

As another tax year draws to a close, investors may be wondering how they can make their investments work harder for them.

While there have been hints of tax cuts, many are still predicting the Autumn Statement to be quite a bland affair as the Government readies itself for a General Election next year, perhaps with more promises for the future than actual action. However, there are still many changes that could be introduced, or re-introduced, that would help boost the economy and put money back into the pockets of ordinary people.

Nobody likes paying too much in taxes, including cryptocurrency investors. Different crypto transactions produce different tax consequences, and how long you own a digital currency usually matters.

Milton Keynes-based asset finance brokerage Approved Finance Group has announced the launch of Approved Tax Limited (ATL), its new division designed to support SMEs with innovative funding solutions.

In the relentless battle against cyber threats, the rise of cyber threats presents an ever-growing challenge for individuals and organisations.

Cybersecurity has become an issue of paramount importance for businesses. But while most enterprise-level organisations are already in control of the primary cybersecurity threats one key area is largely overlooked: Third-party access to external social channels and ad accounts.

Fighting cybercrime is one of the biggest year-round challenges for UK businesses in the ever-changing digital landscape. Startling figures from the Government’s Cyber security breaches survey 2023 reveal a staggering 2.39 million cyberattacks and 49,000 instances of fraud occurred over a 12-month period, costing UK businesses an estimated £15,300 per victim. Charities were also heavily targeted, with 785,000 cybercrimes taking place as hackers attempted to steal passwords, financial information, and other personal data for their own nefarious gains.

Organisations all over the world have been leveraging the power of Windows operating systems ever since the first version – Windows 1.0 – was rolled out in 1985. Yet despite the regular release of newer and more secure versions, many organisations continue to use outdated systems that could leave them worryingly exposed to damaging cyberattacks and data security breaches.

Criminals successfully stole over half a billion pounds over a period of just six months in 2023 through fraud, according to new research from UK Finance.

Research carried out by cybersecurity experts ramsac indicates that human error is responsible for at least 90% of cybersecurity breaches, meaning businesses must do more to protect themselves against cybercrime.

Research carried out by cybersecurity experts ramsac indicates that human error is responsible for at least 90% of cybersecurity breaches, meaning businesses must do more to protect themselves against cybercrime. Unfortunately, around 20% of businesses still don’t have any form of cybersecurity training in place for their staff and rely only on readily available security […]

As an industry, interior design is rapidly growing. To keep up with demand and embrace new ways of working the industry is using innovative technologies and cutting-edge software to envision and deliver client requests. Though there are many gains from innovation, this increasing reliance on technology brings with it a very real threat: sophisticated cyber-attacks.

Welcome to the Q1 edition of Wealth & Finance International magazine. As always, with every issue, we endeavour to provide fund managers, alongside institutional and private investors with the very latest industry news in the traditional and alternative in

Have A Read

Welcome to the Q4 edition of Wealth & Finance International magazine. As always, with every issue we endeavour to provide fund managers, alongside institutional and private investors with the very latest industry news in the traditional and alternative inv

Have A Read

Welcome to the Q3 edition of Wealth & Finance International magazine. As always, with every issue we endeavour to provide fund managers, alongside institutional and private investors with the very latest industry news in the traditional and alternative inv

Have A Read

Welcome to the Q2 edition of Wealth & Finance International Magazine. As always, with every issue we endeavour to provide fund managers, alongside institutional and private investors with the very latest industry news in the traditional and alternative inv

Have A Read

Welcome to the Q1 edition of Wealth & Finance International Magazine. As always, with every issue we endeavour to provide fund managers, alongside institutional and private investors with the very latest industry news in the traditional and alternative inv

Have A Read

Welcome to the Q4 edition of Wealth & Finance International Magazine. As always, with every issue we endeavour to provide fund managers, alongside institutional and private investors with the very latest industry news in the traditional and alternative inv

Have A Read

Welcome to the Q3 edition of Wealth & Finance International Magazine. As always, every issue we endeavour to provide fund managers, alongside institutional and private investors with the very latest industry news in the traditional and alternative investme

Have A Read

Welcome to the Q2 edition of Wealth & Finance International Magazine. As always, with every issue we endeavour to provide fund managers, alongside institutional and private investors with the very latest industry news in the traditional and alternative inv

Have A Read

Welcome to the Q1 edition of Wealth & Finance International Magazine. As always, with every issue we endeavour to provide fund managers, alongside institutional and private investors with the very latest industry news in the traditional and alternative inv

Have A Read

Welcome to the Q4 edition of Wealth & Finance International Magazine. As always, every issue we endeavour to provide fund managers, alongside institutional and private investors with the very latest industry news in the traditional and alternative investme

Have A Read

Welcome to the 2021 Q3 edition of Wealth & Finance International Magazine. As always, we endeavour to provide fund managers, institutional and private investors with the very latest industry news in the traditional and alternative investment spheres. Havin

Have A Read

Welcome to the 2021 Q2 edition of Wealth & Finance International Magazine. As always, we endeavour to provide fund managers, institutional and private investors with the very latest industry news in the traditional and alternative investment spheres. After

Have A Read