Graham Levinsohn, G4S Regional CEO, commented on a “fundamental transition in the use of cash across Europe” which requires “root and branch reform” of how cash is processed by countries in Europe. His comments follow the publication of a landmark report by the Group examining cash use across 28 European economies.

The report finds that the volume of cash transactions across Europe continues to increase, having previously doubled every ten years. Concurrently the proportion of all payments made by cash has fallen, with 40% of payments across the EU now made by card, electronic and digital payments.

In addition:

• The volume of cash in circulation has increased 11% per annum up to 2015 with cash now making up 60% of all payment transactions;

• ATM withdrawals, which are a good indicator of cash spending, increased 14.6% between 2009- 2014, representing an increase in value of €2.188 bn;

• In eight European countries, non-cash payments now make up a greater proportion of transactions than cash;

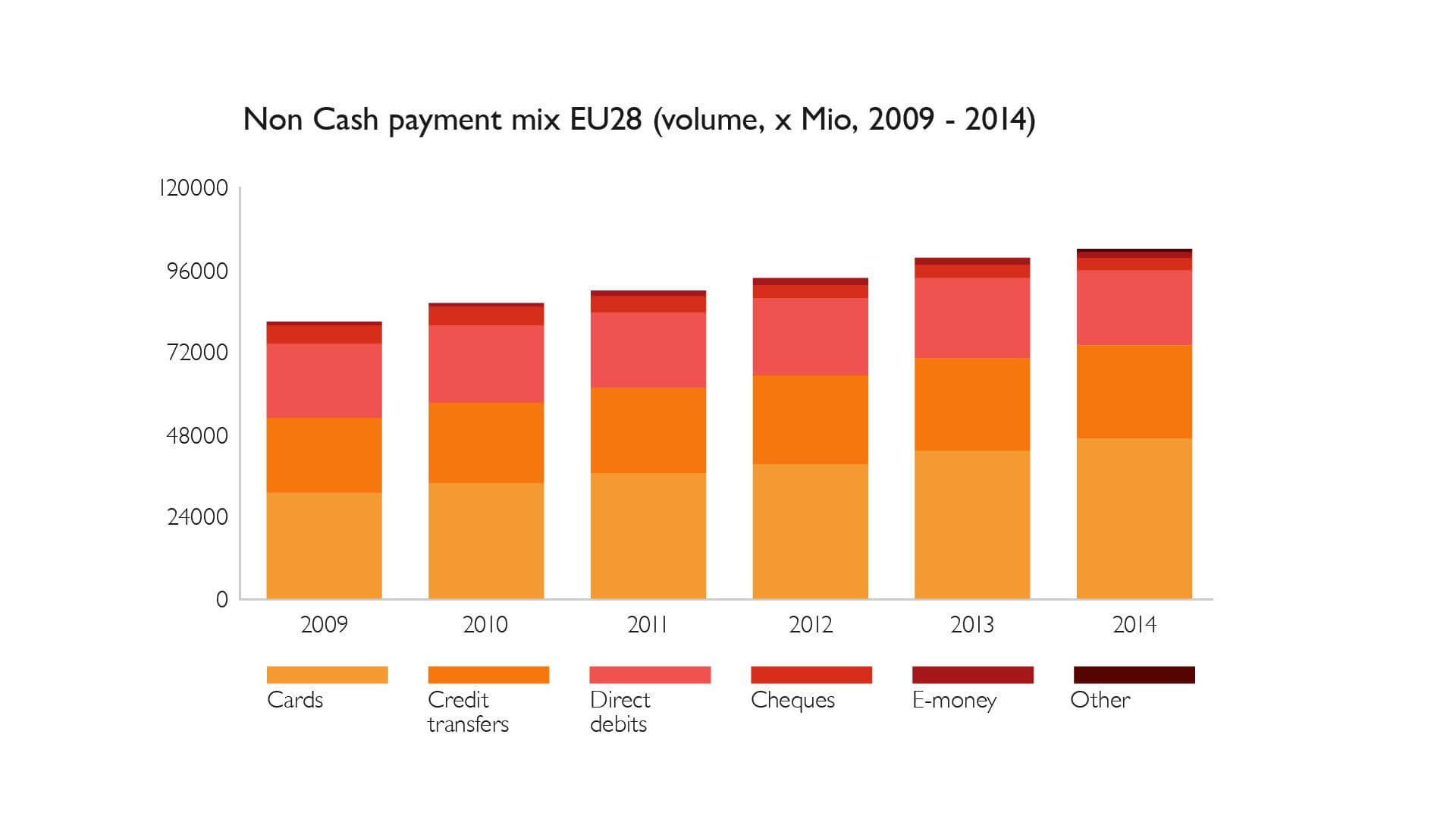

• The total volume of non-cash payments has increased to 102.3 billion transactions.

Commenting on the report, Graham Levinsohn called on the cash industry to work together to modernise cash:

“What we are experiencing is a fundamental transition in the use of cash across Europe. European consumers and businesses will continue to use cash as part of a multi-payment economy. But we need to modernise how they can use it.

“The cash supply chain is highly fragmented across Europe which creates chronic inefficiency. In the most extreme cases cash could be counted up to 17 times from till to bank. However even in less extreme examples, the same cash is handled and counted multiple times as it is transferred between parties in the cash cycle. This creates an unnecessary cost burden on businesses and banks alike.

“We must work together to drive root and branch reform by streamlining and simplifying the cash cycles of Europe, creating fewer transfers between actors and consequently less duplication of effort. Significant cost efficiencies can be driven through the cash cycle so that cash remains a cost-effective payment mechanism into the future.”

Leading a call to action Graham Levinsohn urged the industry to work with the banking sector, central banks and policy makers to create this modern lean cash cycle. Challenges outlined include:

• Shortening the cash cycle: reducing participants, processes, resources and funding from till to bank;

• Realising earlier value: ensuring cash value is credited earlier;

• Reducing the cost of cash: minimising handling and processing costs for cash;

• 21st century cash: better interface with electronic and digital payment methods.