Forward Planning: 7 Easy Tips for Managing Your Retirement Savings

We’ve all dreamed about a blissful retirement, spending more time with the people we love, in places we love and doing things we love. But is it just a pipe dream, or are you financially prepared for the life you wish to lead?

The good news is, it’s never too early to start preparing for retirement. Whilst most of us spend our twenties paying off student debt, as we approach our thirties, our financial priorities change somewhat as we’ve technically been there, done that, got the house, mortgage and family. It’s a time when we experience career progression, leading to promotions, bigger salaries and more funds that can be stashed away for later years.

To help you begin forward planning for the future, Alex MacEwen, expert at The Wealth Consultant has come up with 7 easy tips to get you on your way to achieving the retirement you imagine.

Before we begin, you might be thinking just how much stashing away should we do? According to research commissioned by finder.com:

– 55% of UK adults estimate that they will need £100,000 to live comfortably in retirement.

– Only 28% of people believe they are on target to meet this.

– The recommended amount for a comfortable retirement is between £260,000 – £445,000.

Shocked? Maybe it’s time to start planning the life you deserve.

1. Get independent financial advice

The future is an unknown – How should I save for retirement? Am I saving enough? How much will I need to live on? By enlisting the help of a professional, independent advisor, you will find the answers to all these vital questions. Your independent financial advisor will help you plan and make decisions based on your lifetime goals. They will advise on the various products that most suit your needs instead of pushing a product to boost their sales.

2. Create a realistic spending plan

Determine a budget by assessing your income, salary, interest, dividends, any rental income or child support. Define your outgoings, housing bills, utilities, transport, food, perhaps you are still paying off student loans. Decide on the things you really could sacrifice in the name of saving – do you need so many European city breaks? Are you still paying membership fees for facilities you never use because you keep forgetting to cancel the membership? Scrutinise your balance sheet and commit to saving as much as you can. Your future self will thank you, trust me.

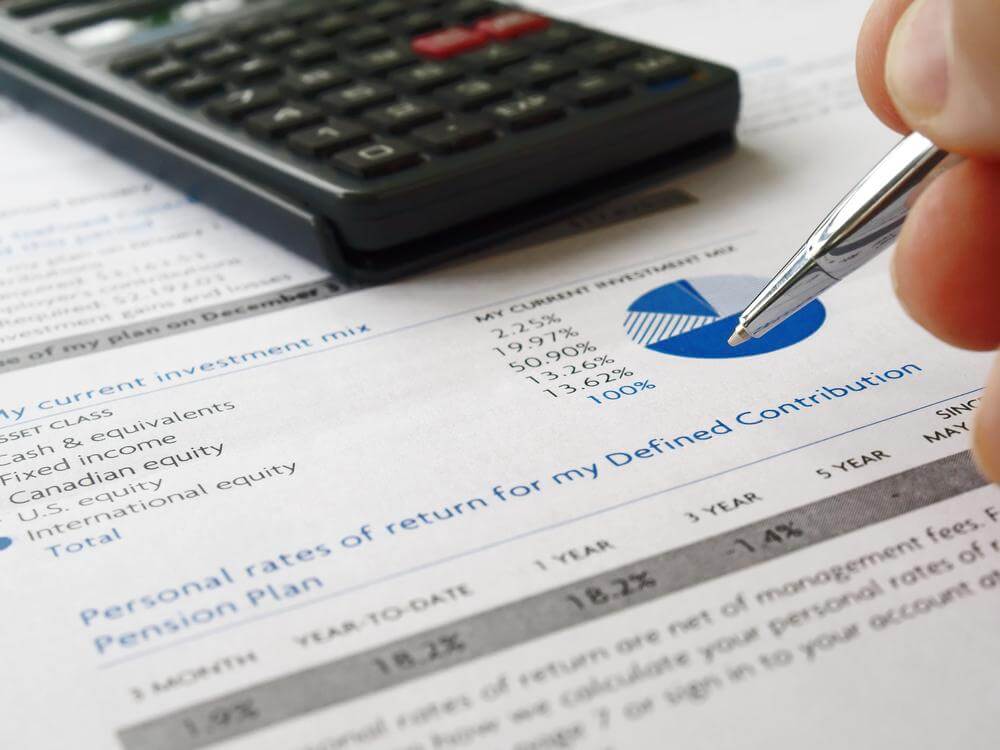

3. Monitor old and new workplace pensions

It’s easy to get caught up in the excitement of landing a new job and just as easy to lose track of your old workplace pension! But it is important to keep track to know the value of your pension pot as this will help you decide whether it’s worth merging the old pension with the new one, and will give you an idea of how much you have saved for the future. It’s important to check the pension management fees as your previous employer will stop making contributions to old funds once you change jobs, the fees keep rolling, depleting your pension pot in the process. If you have a defined contribution pension, it is always worth checking where your pension funds have been invested, both from a risk level perspective and to ensure it aligns with your values.

4. Review investment performance

Keep track of your investments to ensure your portfolio is flourishing. If something isn’t working, figure out why. Perhaps it’s just a case of sitting tight and keeping your cool, or maybe time to diversify into a different sector or explore international opportunities to minimise losses. Remember, even if you have a few disappointing investments in your portfolio, a portfolio that is steadily increasing in value is always a sign that conditions are good.

5. Minimise retirement tax

After spending a lifetime working and sensibly putting money away for retirement, it’s important to ensure you keep as much as that money as possible. How? By ensuring your savings are as tax efficient as possible. This will mean working with an experienced financial advisor to ensure you are making use of all the tax allowances and pension tax relief.

6. Estate planning

Your inheritance and estate plan should set out your values and your intentions for how you wish your estate to be divided up and managed when the time comes. By focusing on your estate planning now, you can manage your tax obligations and safeguard the financial stability of those you hold dear. Inheritance matters can be challenging emotionally and financially, so it’s important to get professional advice and protect your wealth for future generations.

7. Save as much as you can

Save as much as you can, while you can. Achieving your dream retirement means making small short-term sacrifices in favour of saving for the future life you want. Remember, topping up your pension now means you will benefit from tax relief up to the annual limit of £40,000.