The world’s 75 largest luxury goods companies generated luxury goods sales of £102 billion through the end of last fiscal year (fiscal years ended through June 2013) despite a slowdown in the global economy, according to the inaugural Global Powers of Luxury Goods report issued by Deloitte Global.

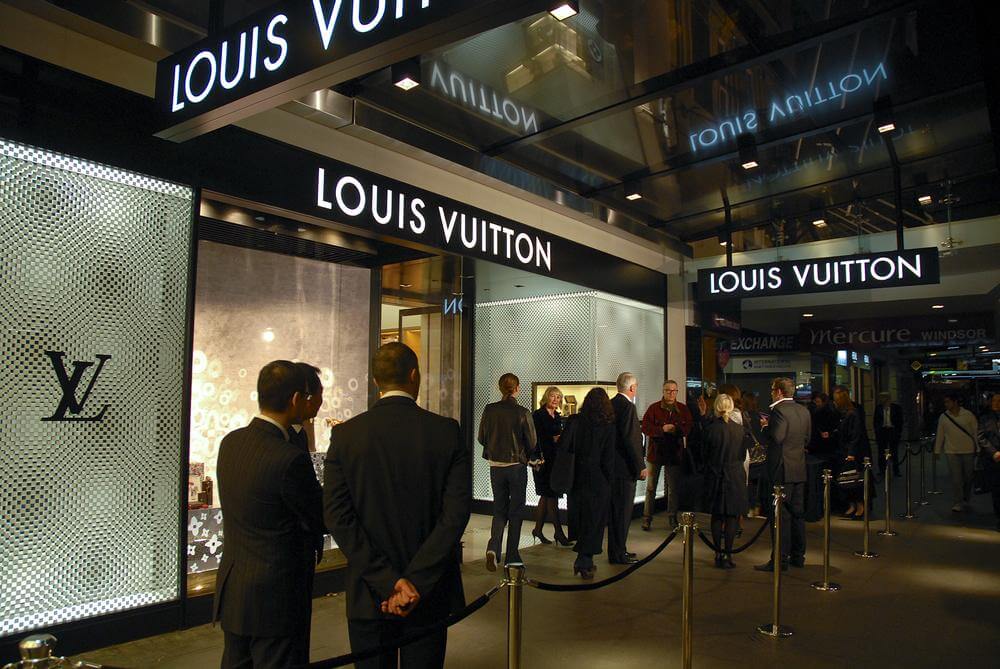

The average size of the Top 75 companies was £1.4 billion in luxury goods sales. The report identifies the largest luxury goods companies around the world—with LVMH taking the top spot. It also provides an outlook for the leading luxury goods economies, insights for mergers and acquisitions activity in the sector, and discusses the major trends affecting luxury goods companies, including the retail and ecommerce operations of the largest 75 luxury goods companies.

“Despite operating in a troubled economic environment, luxury goods companies fared better than consumer product companies and global economies generally. For the remainder of this year, we expect growth in developed economies to pick up speed while significant risks in emerging markets remain,” said Ira Kalish, chief economist, Deloitte Global. “Overall performance of the luxury sector will depend not only on economic growth, but on factors such as volume of travel, protection of intellectual property, consumer propensity to save, and changing income distribution.”

The report focuses on the high concentration of luxury goods companies headquartered in France, Italy, Spain, Switzerland, the United Kingdom and the United States. These six countries represented nearly 87 percent of the Top 75 luxury goods companies and accounted for more than 90 percent of global luxury goods sales in 2012. France, Italy, and Switzerland achieved strong composite luxury sales growth in 2012, with France and Switzerland outpacing the 12.6 percent composite growth for the Top 75 at 19.4 percent and 14.8 percent, respectively. Italian luxury goods companies grew in tandem with the Top 75 at 12.4 percent. Countries trailing the Top 75 composite were Spain, the United Kingdom and the United States, with the United States having the smallest growth at just 5.6 percent.

“In the US, luxury goods should benefit from both domestic consumers and international travellers,” said Alison Paul, vice chairman and US Retail & Distribution leader, Deloitte LLP. “A broader product selection and price advantage compared to travellers’ home countries makes the US an attractive luxury market for international tourists, which include an expanding middle and upper income groups from emerging markets. Here in the US, an increasingly more positive outlook is a result of income growth among higher-income households and the seeming wealth effect of the stock market’s recent gains.”