The stamp duty exemption for securities trading on growth markets, coming into effect on Monday 28th April, will give investors a further reason to back ambitious companies but is unlikely to have much impact on where issuers choose to list, says a partner at law firm Hogan Lovells.

The new exemption, announced in last year’s budget, is intended to incentivise investor participation in the UK’s growing small and medium-sized quoted businesses. It is widely viewed as a positive move by the government, particularly amongst the Small and Medium Enterprise community. Shares traded on certain growth markets, including AIM and the new High Growth market, will qualify.

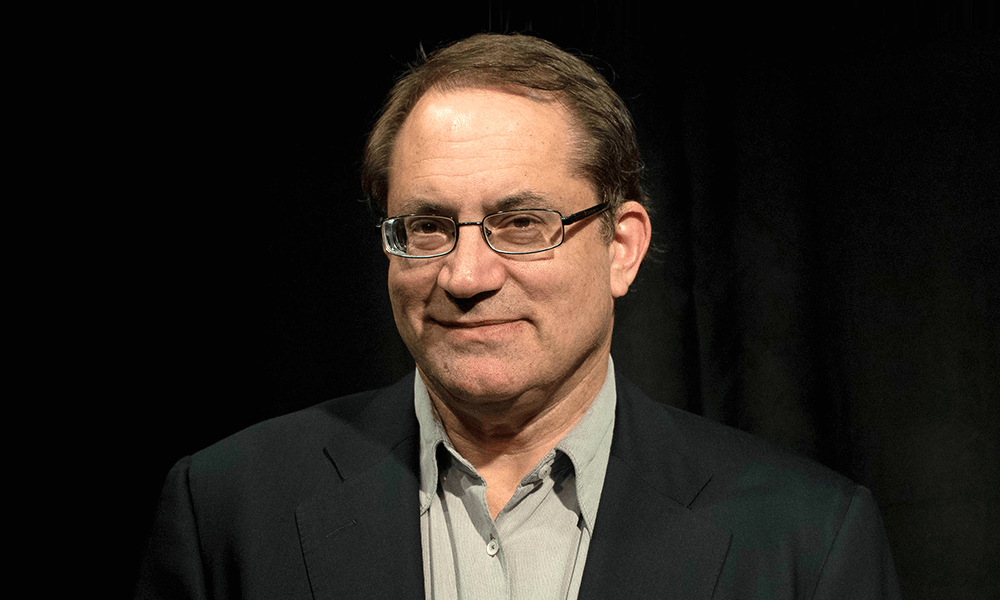

Maegen Morrison, a partner in Hogan Lovells’ London office, says that, traditionally, larger funds and investors have been wary of investing in “start-ups” which are seen as high-risk and whose stock tends to be relatively illiquid, and so the forthcoming exemption gives investors a further reason to back ambitious companies. “But we are unlikely to see any significant impact on where issuers choose to list,” she says. “Investors will want to consider the whole investment story of new businesses – and lower investment costs will be an added bonus, rather than a game changer.”

The exemption is only available to companies trading on growth markets which do not have a full listing elsewhere. This is to allow growing companies to benefit from the exemption, whereas companies with full listings on other markets are likely to be larger and more established.

While this means that there will be companies which do not qualify for the exemption, and therefore will have a competitive disadvantage regarding qualifying companies on the same market, investors will make decisions based on the whole “investment story” of the issuer, rather than be swayed by lower investment costs, says Morrison.

“However, where such companies are fully listed on stock exchanges for historical reasons (for example, on the Johannesburg Stock Exchange) but the majority of their investor base has migrated to a growth market, such as AIM, we may see those companies choosing to de-list from those exchanges but maintain their trading on the growth market in order to afford their investors the benefit of the new exemption,” Morrison adds.