New Tool Shows The FTSE 100 Is Recovering Slower Than Other Global Markets

The Coronavirus lockdown decimated economies all over the planet, but while some stock markets are showing signs of recovery, the UK’s FTSE 100 is taking longer to bounce back.

Since falling to its lowest point in March, the FTSE 100 has climbed by 23%, which seems impressive, until you compare it with other global indices. Both the Nasdaq and Dax have risen by over 50%, while other key markets, such as China’s CSI 300, have also significantly outperformed the FTSE since the pandemic hit.

Chris Beauchamp, chief market analyst at IG Markets, Europe’s largest online derivatives trading provider, believes the FTSE 100 is “an index that has become a victim of its own composition”. Financials currently represent its biggest sector and Beauchamp says “a huge chunk of the index in terms of weighting is really underperforming”.

He adds that the recent resurgence in sterling has also hit the FTSE, as its firms have lost value overseas.

For traders looking to keep track of the global indices and their relative rates of recovery, Daily FX has launched an innovative new tool that provides an instant snapshot of international market performance.

Market Health allows traders to get a complete picture of global markets and indices in a single place. The free tool provides an instant picture of global market performance, currency strength and exchange opening and closing times.

Using data from Quandl, Market Health allows users to take a macro look at global markets and indices including the Dow Jones, S&P 500, FTSE 100 and DAX 30 to help formulate and deliver on trading strategies.

Split between three main viewpoints, users can easily switch between world overview, stock exchange open times and index performance.

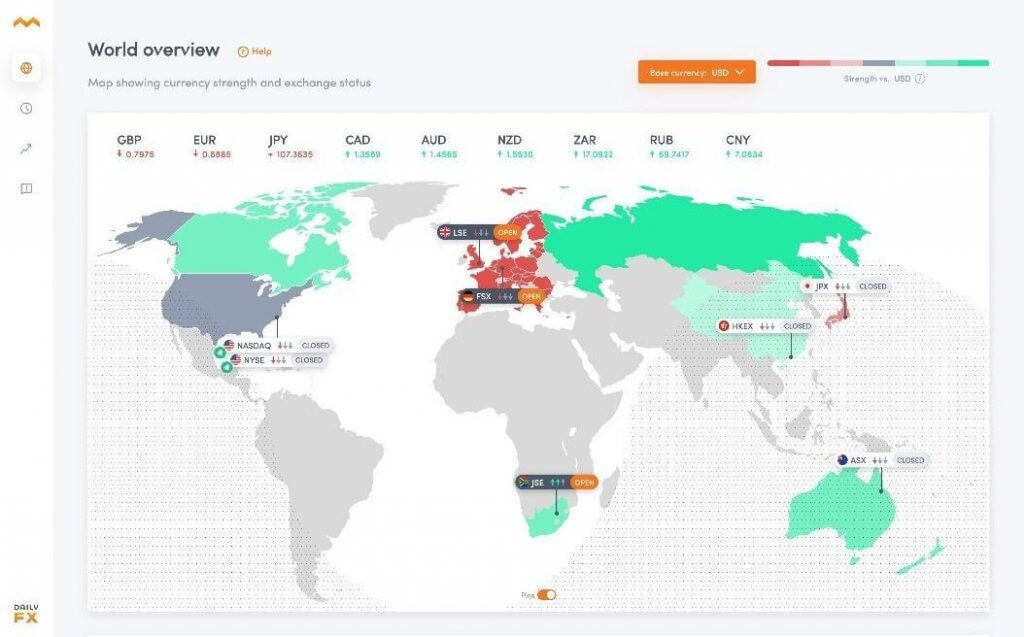

The global view combines exchange opening times and currency performance, presented on a world map. The map, displayed as a heat map, shows currency strength against a base currency of your choice.

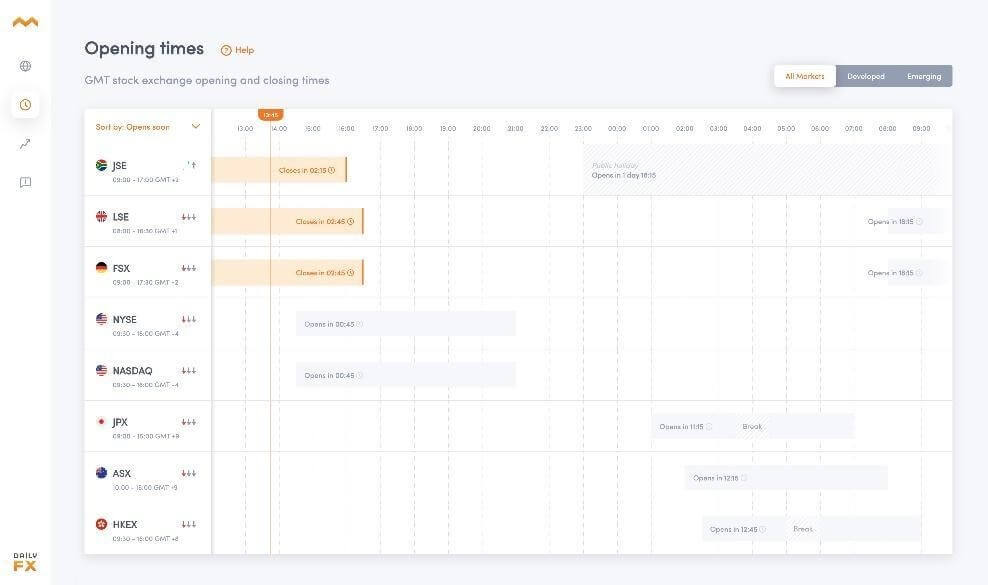

The stock exchange opening times showcase eight global stock exchange markets with details of exactly when they open and close, how long they’re open for and whether or not they’re closed for any public holidays.

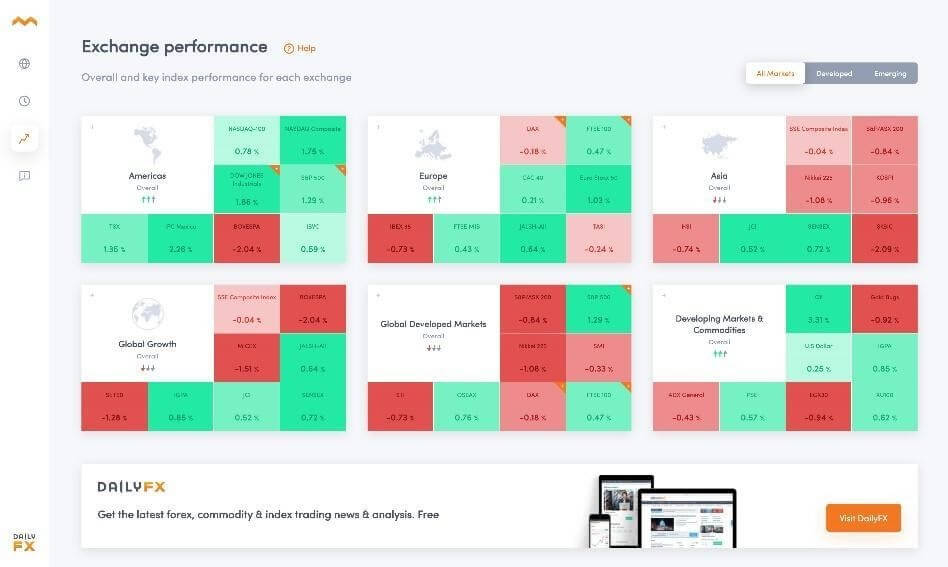

The performance section groups major market indices into geographical groups and is a quick way to get a picture of whether a geographical market is up or down. Users can also filter by developed or emerging markets.

Peter Hanks, Analyst at DailyFX, explains how the tool is useful for experienced traders like himself: “It is useful to use the tool on specific days when trying to discern which market or region was most impacted by an event. For example, if the Federal Reserve has an interest rate decision, since the central bank typically has the most influence over the American markets, we would expect to see the most activity in those regions. If, on the other hand, another region has outpaced the US markets, there may be another theme at play that is driving market activity, so the tool is great at providing a bird’s eye view of the market.”

He goes on to explain how the tool is also useful for new traders: “When starting off on your trading journey, understanding the impact of other market sessions is very important. Volatility in one region can easily carry over into another, so being aware of when regions are active or inactive is very useful as the crossover periods are often flush with liquidity and can set the tone for an entire session.”

He explains how the tool is useful in the current situation: “Having an instant view of global market health is particularly useful for fast-moving world events such as today’s pandemic. The Market Health tool will be useful to many for getting a quick snapshot of what Covid-19 is doing to the world’s economies and how the different markets are reacting as we are all in different stages of the health crisis.”

David Iusow, Market Analyst at DailyFX, said: “Before a day begins, a trader needs to know how markets around the world have performed in other time zones. It is the first overview that one can get of the general market conditions and from which one can deduce the start of trading on the domestic stock exchange. Similarly, a market status map facilitates the identification of relative outperformance of markets during regular trading hours. The DailyFX market status has the advantage of a clear and interactive structure, giving traders exactly the benefits, they need to start a day.”

To use the Market Health tool click here: https://www.dailyfx.com/research/market-status