Investing can be challenging, especially for beginners unfamiliar with the intricacies of the investment market. Important details such as what products to invest in, how much to invest, and when to invest should be considered, as they can be determining factors in the success of an investment portfolio.

A well-designed investment portfolio is essential to achieve long-term financial goals, such as retirement planning and wealth creation. It can provide a steady income stream, capital appreciation, and diversification. This guide focuses on building an investment portfolio and provides critical tips to help you get started.

1. Work With A Fund Manager

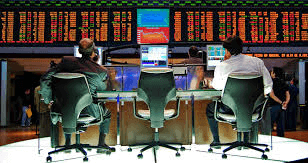

One crucial point to consider when building an investment portfolio is to work with a fund manager. As a beginner, you’re likely unfamiliar with the intricacies of investing. Hire a knowledgeable fund manager to teach you how to invest and provide valuable expertise and guidance.

A fund manager is a professional who specializes in managing investment funds on behalf of clients. They have a deep understanding of the financial markets and can help you navigate the complexities of investing.

When choosing a fund manager, research and select someone with a solid track record and a suitable investment strategy that aligns with your goals and risk tolerance. By working with a fund manager, you can access diversified investment options and benefit from their expertise to make informed investment decisions. Additionally, evaluate their investment strategy and consult with them to create a tailored investment portfolio that aligns with your financial objectives.

2. Determine Investment Goals And Period

Another crucial tip is to determine your investment goals and the period in mind. Setting clear and specific investment goals is essential for guiding investment decisions and strategies. Whether aiming for long-term growth, capital preservation, or generating income, defining your objectives helps you select suitable investment vehicles and allocate your resources effectively.

Considering the period for your investments is vital, as it influences your risk tolerance and the choice of assets. If you have a longer time horizon, you may be more inclined to invest in higher-risk assets with higher returns. Conversely, a shorter time frame might necessitate a more conservative approach. By carefully assessing your investment goals and time horizon, you can build a portfolio that aligns with your aspirations and helps you achieve your financial goals.

3. Understand Your Risk Tolerance

Understanding your risk tolerance is fundamental to building an investment portfolio, especially for beginners. Risk tolerance refers to your ability and willingness to withstand fluctuations and potential losses in the value of your investments. It is crucial to assess your risk tolerance before making any investment decisions, as it helps determine the appropriate allocation of assets in your portfolio.

Factors such as your financial goals, time horizon, and personal comfort level with volatility significantly determine your risk tolerance. For example, if you are investing in a retirement plan in your early thirties, you may be more willing to take on higher risk than if you have less than five years until retirement. By understanding your risk tolerance, you can balance potential returns and the level of risk you are comfortable with.

4. Choose Your Asset Allocation Well

Asset allocation denotes the distribution of your investment across different asset types, including bonds, cash, and stocks. Beginners must carefully consider their risk tolerance, financial goals, and time horizon when determining their asset allocation. Generally, stocks have a higher potential for growth but greater volatility, while bonds offer stability and income but may have lower returns.

An investor’s age can also influence their asset allocation. When you’re in your 20s, investing about 70% of your portfolio in stocks and about 30% in bonds is advisable. However, when you’re in your 50s, the investment should shift to about 50% each.

5. Diversify And Review Your Investments

Diversifying your investments across various asset classes is recommended to reduce risk and optimize returns. You may also explore other investment options, such as cryptocurrencies, real estate, and commodities.

Regularly reviewing and rebalancing your asset allocation based on changing market conditions and your evolving investment goals is also crucial for maintaining a well-rounded investment portfolio.

Conclusion

Building an effective investment portfolio is crucial for achieving financial success. By following these tips, you can build a tailored investment portfolio that aligns with your financial objectives.

Start by understanding and determining your risk tolerance, setting clear goals and time frames, and allocating assets across different options. Consult a professional investor or advisor for valuable advice tailored to your financial situation and objectives.