Category: Digital Finance

Showing page 1 of 2 with 43 matching results.

Say you’re a creative genius that has put in a lot of time, effort, and resources, along with your whole team, in researching, drafting, fine-tuning, and refining a product in the United States.

There’s a fact that resonates well with almost every industry out there: information technology (IT) systems empower American organizations of all sorts to reach their goals.

Navigating the UK’s evolving economic landscape has proved challenging for many charitable organisations relying on fundraising, as disposable income fell by 2.2% in the 2022/23 financial year.

2024 so far has been a relatively quiet year for FX markets. However, in the past month, volatility has started bubbling up again, bringing FX risk management to the fore for many businesses. In April, Bloomberg’s gauge for hedging swings jumped to its highest since January, influenced by the ongoing conflict in the Middle East and speculation that the Fed will have to hold monetary policy tight for longer.

With summer fast approaching, maximizing the excitement of a future holiday and minimizing the stress of the entire process is essential.

Did you know that 90% of the world's data has been created in the last two years? As businesses continue to generate and rely on vast amounts of data, implementing robust data governance has become more critical than ever.

We live in the era of modern technology, and we are supposed to understand it. New technologies are introduced into society almost daily, and software development is one of the most important areas driving these advancements.

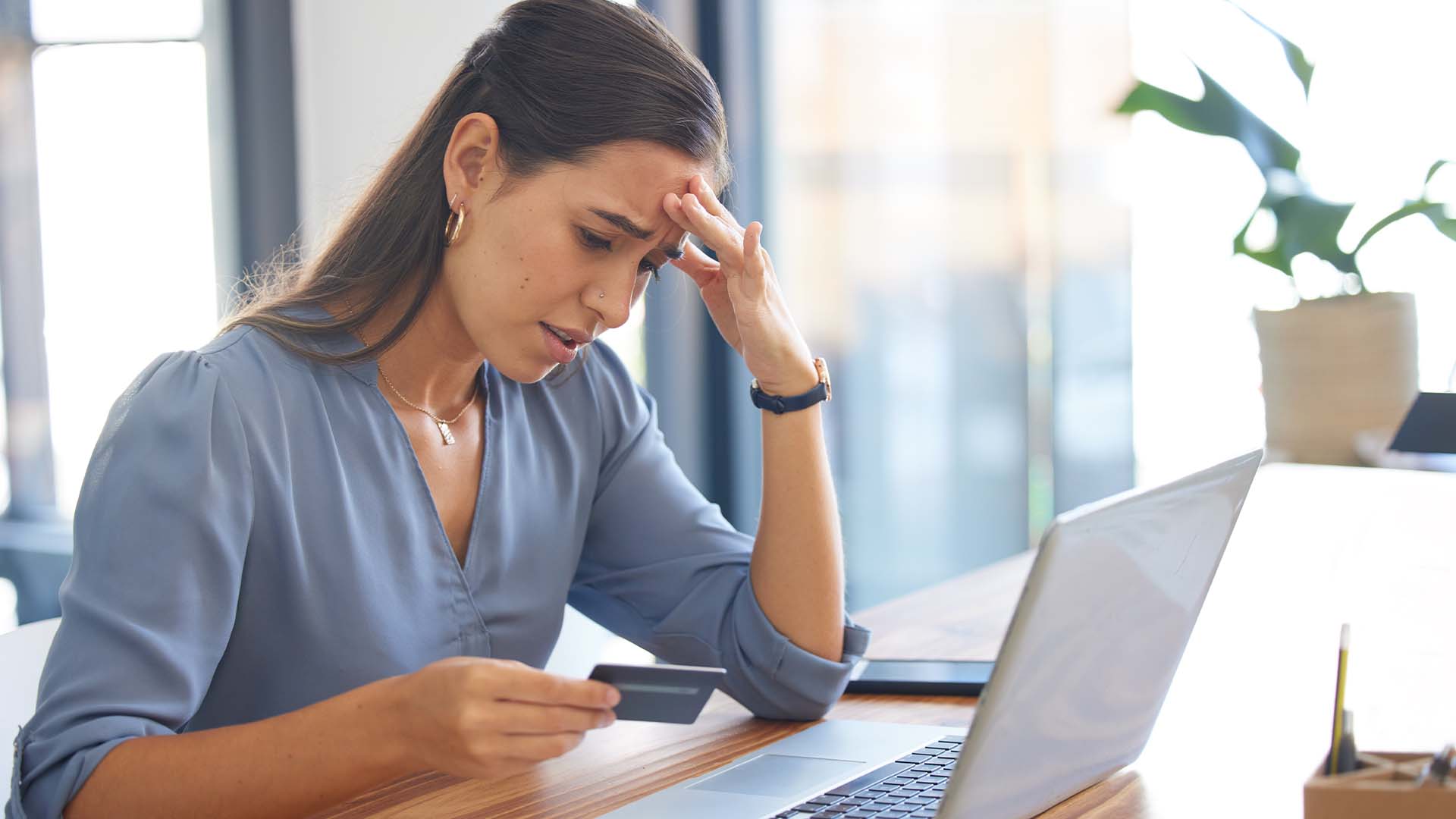

When it comes to online shopping, customers aren’t the only ones who can fall victim to scams. Many scams target businesses and sellers instead, therefore anyone selling goods online must know how to avoid being impacted and what to do if their business is affected.

The value of Bitcoin was predicted to skyrocket following the Bitcoin halving, causing a surge in interest from people who want to invest in cryptocurrency.

Cryptocurrencies have taken over the world of consumer and professional finance over the last several years, but how do they actually work? It's probably best to think of cryptocurrencies as digital assets that are secured by cryptography.

In the ever-evolving world of trading technologies, one term has risen to prominence, leaving an indelible mark on the financial landscape: tokenization.

International payments power the global economy, but for many businesses cross-border transactions are still in need of modernisation. Laurent Descout, Founder and CEO of Neo, looks at the progress that has been made so far and the solutions that can drive payment innovation further.

Criminals successfully stole over half a billion pounds over a period of just six months in 2023 through fraud, according to new research from UK Finance.

Armed with the capabilities of machine learning (ML), financial institutions and finance executives have long been turning unstructured information into insights that promote better decision-making and help them understand many key elements of the business.

An all-new, intuitive trading offering is now live. Tradu is the innovative platform that gives traders and investors enhanced access to the essential tools and assets that establish and grow a trading portfolio.

Artificial intelligence (AI) is everywhere you look, and the financial services sector is no different. Banks and other financial firms like hedge funds were some of the first institutions to adopt artificial intelligence at a corporate level, while new technological advances and applications mean that AI usage is more widespread than ever.

Sadly, cybercriminals don’t take breaks over Christmas. In fact, with so many more financial transactions taking place over the festive season, it’s a prime opportunity for cybercriminals to take advantage of poor cybersecurity. The Christmas season is a perfect background for a cybercriminal to attack, so what are the most common ways that you could be caught out this festive season?

Access brokers — the threat actors who gain and sell access to organisations and simplify eCrime for other cybercriminals — are especially active during this time of year. They capitalise on seasonal shifts to craft holiday social engineering campaigns, steal more information and make more money by selling their findings to threat actors on underground forums.

In the face of rapidly increasing data volumes, relentless cyber threats, a critical shortage of skills, and the intricate demands of regulatory compliance, a startling 95% of businesses perceive their digital infrastructure as a risk to their operations.

The modern business model is one of agility. In the past few years, we have seen a growing number of small and medium-sized enterprises (SMEs) discarding traditional, hierarchical ‘top down’ infrastructures and creating flatter and more flexible structures.

The total number of payments (consumer and business) in the UK last year increased to 45.7 billion, up from 40.4 billion in 2021.

Artificial intelligence (AI) is taking the industry by storm, improving customer service, boosting safety transactions, reducing missed payments and battling financial crime

A recent report from the Royal United Services Institute (RUSI) has called for greater cooperation between government bodies, insurers, and cyber security specialists to establish best practice guidelines on dealing with cyber-attacks and ransomware.

Steering a business without a clear vision of the future is like navigating uncharted waters without a compass. Financial forecasting can provide you with direction.

In today’s rapidly changing business landscape, meeting the highest security standards, processing large amounts of confidential data and ensuring service availability is more crucial than ever. According to Krzysztof Michalik, Head of Delivery - FinTech Stream at STX Next, data engineering can play a key role in supporting the modern business with meeting these requirements, especially fintechs, banks and financial institutions that are handling growing volumes of sensitive, unstructured data.

Technological innovations in fintech are continuing to evolve, as we reach the halfway point of 2023. Gen Z is leading the way for fintech service adoption as physical cash continues to diminish, whilst digital wallets, robust blockchain offerings and super apps grow in popularity.

The purchase of cybersecurity solutions/services (66%), as well as cybersecurity training (57%), are the most popular IT investments among British businesses this year, according to the newest research by NordLayer, a network security solution for businesses.

Is your business operating as efficiently as it could be? For smaller businesses and startups, maximising efficiency can be the difference between surviving and thriving. In today’s rapidly-evolving commercial landscape, being an early adopter of the latest technology can set your business apart from the rest, open the door to a wider market of potential customers or simply help cut costs.

Quantum computing will light the way for hackers to identify and attack air-gapped servers — high-security computers once thought immune to data theft — new analysis by the cybersecurity consultants Cystel has revealed.

A number of high-profile cyber-attacks in 2021 have thrust cybersecurity back into the spotlight. In light of the HAFNIUM hack, cybersecurity has become a major focus for many businesses.

Over the past five years, ransomware attacks have risen exponentially worldwide and high-profile attacks dominated the headlines last year.

First, it was the traditional bricks and mortar high street bank to fall out of favour with customers, then physical cash itself – now, time could be up for physical bank cards as well. The way we bank and engage with finance is becoming increasingly mobile-centric – especially on a day-to-day basis.

Algbra is on a mission to eradicate social and financial exclusion and provide ethical and sustainable financial services to everyone. The platform offers a range of financial services, and is built on state-of-the-art financial technology. Algbra's commitment to ethical finance means that money will never be held in a high-risk way or be exposed to unethical industries.

Brits think white-collar criminals have an easy ride in the UK, with fraudsters not being brought to justice. In fact, 59 per cent believe that if they were to report an incident of white-collar crime to the police or a relevant body, nothing would be done about it.

Brits have more stolen payment card details listed for sale than any other country in Europe, according to new research of dark web data by cybersecurity company NordVPN.

Keeping a business safe and secure will always be a top priority for business owners and despite best efforts at tight security, some businesses do find themselves victim to break-ins or other illegal activities.