Congratulations on Absolute Value Capital Management being named Hedge Fund Manager of the Year – 2015

Thank you.

The U.S. stock market was down a bit last year. Bonds aren’t yielding much these days. How does one achieve triple digit returns in such an environment?

Back in early 2011 I saw commodities markets were peaking and being on the verge of a long nasty bear market. I wanted to go on record as predicting the end of the secular bull market in commodities so that when I turned bullish I would have established a bit of credibility. So I started writing articles for a financial news website. Commodity cycles seem to have a pattern. Commodities do not do much for a long time. Then there is a fantastic spike up for nine years. Then there is a crash. Lather, rinse and repeat.

So what you want to look for is a big 9 year spike in commodities. The biggest one was 1613-1622 when commodities went up 254%. That immediately led to a 50 year 78% bear market.

Number two on the list is 1938-1947 when commodities went up 240%. Commodities went down 16% in 1948, down 19% in 1949, up 58% in 1950 and peaked in January 1951. Then they had a 39% 18-year bear market. Therefore, in the quarter century after the 1947 signal, the upside was 12% (January 1951) and the downside was 32% (August 1968). Coming in at #3 is 2001-2010. Commodities went up 238%. They peaked in April 2011 and have since declined by 48%. From 1910-1919 commodities went up 202%. They peaked in April 1920 and then went into a 13-year 74% bear market. From 1971-1980, commodities went up 198%. Commodities immediately went into a 19-year 45% bear market. Furthermore, over the last century or so, the timing of these commodity cycles has been regular.

The major peaks in commodities were April 1920, January 1951, November 1980 and April 2011. The tops are roughly 30 years apart. So at the end of 2010, you had a situation where, going back to 1259 (the starting point of my data), the maximum historical upside was quite limited. Not only that, but a top was overdue with respect to the 30 year cycle.

I am getting the sense you were not bullish on commodities last year.

This has been the worst commodity bear market in the last 83 years. The Barron’s Gold Mining Index recently hit the worst bear market in history mark. The inception date of this index is in 1938. The previous bear market record was -82% from 1980-2000. The bear market which started in 2011 is already down 85%.

Prior to 1938 the data gets rather dodgy, but it looks like this is the worst gold stock bear since at least 1920. So over 95 years. The junior gold mining stock ETF, GDXJ, has already gone down by over 90%. During the early 2000’s tech crash, an Internet index went down 95% and a telecommunications index dropped by 93%. The Russian stock market went down 93% in less than a year in 1997-98. The internet and telecom indices subsequently rallied 410% and 271% from their bottoms over the next 5 years. The Russian stock market went up by 6,384% in less than ten years!

However, before you mortgage the house, be aware the Baltic Dry Index is still down by 97% from its 2008 high as of late January 2016. There are two commodity indices that I follow. The ^CCI is an equal weighed commodity index and the ^CRB has more of a “real world” (i.e. energy) weighing. In January 2016, the ^CRB index hit its lowest level since 1973!

How low can commodities go?

Since 1933, we have had bear markets of -36%, -39%, -23%, -45%, -47% and the current one is -48% as of this interview. But if you look at 1622 to 1933, we had commodity bear markets of -78%, -77%, -68%, -79% and -74%.

Why were the pre-1933 bear markets more draconian in nature? A major reason is FDR took the US off the gold standard in 1933. From 1665 to 1932, the annualized inflation rate in the United States was 0.16%. From 1932 to today it is 3.49%. If you look at charts from the 1200s to 1932, they looked like a sine wave. Post 1932 the charts look like a sine wave tilted up to the right.

So the question is will the current commodity bear act like a typical post-1933 commodity bear? In that case the downside is limited. But if you look at pre-1933 scenarios it can get much worse. In light of this ambiguity, the short side in commodities is not as exciting as it was back in 2011 or even a year ago. But there are a lot of other indicators giving off interesting readings right now. For example, two indicators have given off signals which have led to triple digit gains in one asset each time they have gone off. I am excited about 2016.

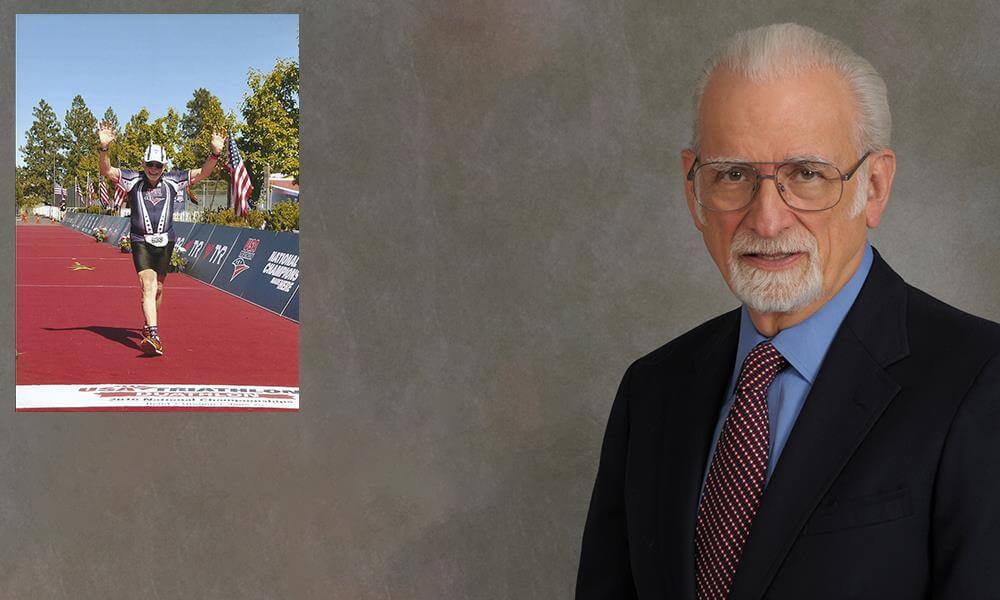

Company: Absolute Value Capital Management

Name: James Debevec

Email: [email protected]

Web Address: www.absolutevaluefund.com

Telephone: 001 (954) 973-1428