Jammal Trust Bank SAL draws its financial strength from conservative asset and liability management policies, as well as a high-quality asset profile and deposit base. With a proven track record spanning almost 50 years, JTB provides tailor-made, innovative financial products and services.

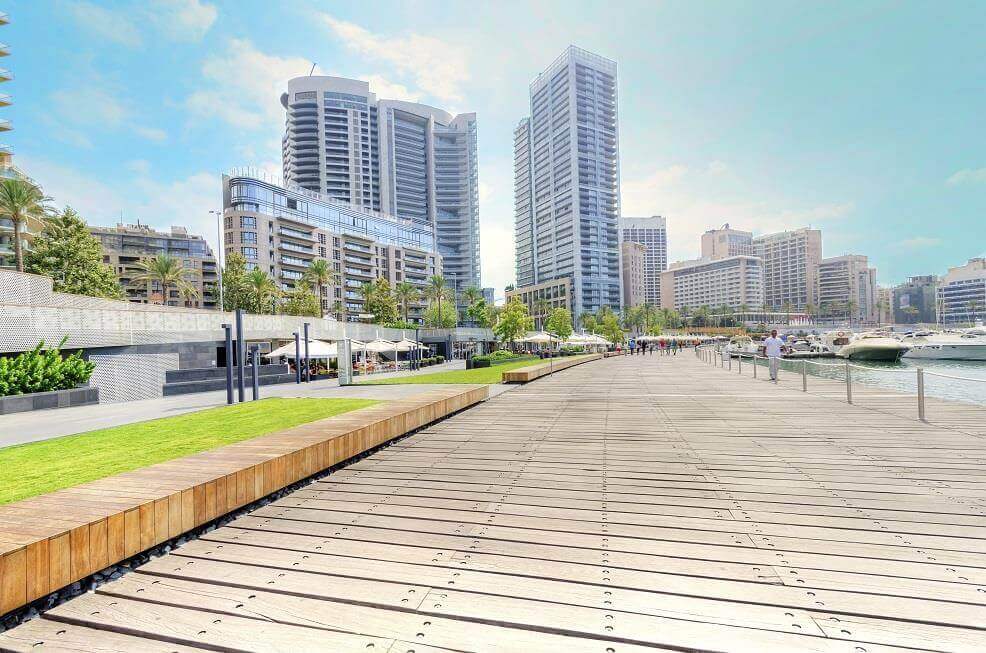

We have a large network of branches throughout Lebanon, primarily in para-urban areas, where JTB prides itself for being one of the few banks to support and serve Lebanon’s SME market through commercial lending thus contributing to economic growth and development rather than less productive financial instruments and government securities.

The other important characteristic distinguishing JTB is the fact that JTB’s client base includes major private sector corporations, financial institutions, multinational companies all active in the region and west African states which provides the Bank with protection from risk related exposure to single market. JTB has gained experience for project and trade finance and as a major player in the local syndicated loan market.

JTB enjoys a reputation among its versatile customer base and the market at large for delivering and ever improving a highly personal service and very quick responsiveness to our client’s needs. This reputation is merely a reflection of JTB’s core values and deep rooted philosophy articulated in its logo and motto, “We Speak Your Language”.

With significant improvements continuing across all major business activities, the Bank set in 2009 on a growth path which continues to fuel restructuring and expansion strategies. This exceptionally strong year-on-year advance reflects increases in both interest and non-interest earnings and a reduction in provisions for credit losses, demonstrating the success of JTB’s ongoing strategic initiatives, coupled with an effective and proactive management of risk. The results clearly depict the soundness of the Bank’s new retail banking strategy introduced a few years ago, focusing primarily on Lebanon and the Western African States, which has increasingly contributed to a diversification of a steadily growing flow of recurrent earnings. JTB continued to provide shareholders with enhanced returns, while maintaining favorable recognition from clients, counterparties, regulatory authorities, and market observers.

Despite the turmoil in the region, signs of economic improvement remains acceptable; coupled with a stable domestic performance has stimulated substantial vigor in JTB’s business since the introduction of its new retail strategy a few years back. As a result, there have been strong contributions across all major operating activities, enabling the Bank to achieve record levels in financial performance.

JTB’s prospects for the years ahead continue to look encouraging. This is supported not only by the promising economic and business environment, but also by JTB’s more balanced earnings profile, and an increased focus on marketing and new products and services’ development.

In addition, the demand for overall banking services is expected to increase as important structural reforms in the country’s financial infrastructure gather pace.

A major thrust on retail banking activities improved the sector’s contribution to the overall income of the Bank in the last three years through the implementation of a carefully formulated business development strategy that focuses on increased market penetration and product diversification. The Bank also expanded its capabilities in the provision of specialized lending to Small & Medium Enterprises (SMEs). The Bank maintained its active role in providing financing for the corporate sector as well.

JTB believes that there is ample room to further leverage the distinctive advantage it has, by enjoying a privileged access to niche markets both on-shore and off-shore. Such efforts will rest, as defined in the detailed Strategy and Business Plan, on adopting an all-inclusive approach to service large clients and to attract prospects.

In summary, client relationships will be viewed as a whole, with possibly an introduction to doing business with the Bank via documentary credit or other commercial banking facilities and graduating to a web of more complex intertwined services quickly rendering JTB an indispensable business and financial partner for the client and creating efficient and soft barriers to exit.

Service quality is the key element for the success of this approach and the Bank has developed a fully integrated system and processes for the purpose of delivering an ever improving relation based on purposeful contact, dynamic client profiling, focused determination on client needs, long-term inter-generational planning and total availability of the relationship manager of the Bank.

Amidst the economic regional conflicts, the Lebanese financial sector shows great resilience and has high hopes in a prompt economic recovery. Our faith in Lebanon, our sturdy abilities and our strong belief in the Central Bank astuteness boost our determination to keep developing all existing business lines, to expand our branches’ network and reinforce off-shore activities. Last but not least, continue to provide our stakeholders with enhanced returns while maintaining favorable recognition from counterparties, regulatory authorities and market observers.

Company: Jammal Trust Bank SAL

Name : JTB SAL

Email: [email protected]

Web Address: www.jtbbank.com

Address: Verdun Street, Beirut, Lebanon, P.O.Box 11-5640

Telephone: 00961 (1) 781999