Swiss International is a financial services company that facilitates the entire process of participating in global financial markets. Being an integrated service provider – they cover the entire process from ‘research and advisory’ services – to the ultimate ‘execution and clearing’ of a transaction. In a special interview, the firm’s Ahmad Shibley reveals more about the world-class quality services they provide for their clients’, and their unrivalled reach into global markets. The firm is both an asset management company and a finance Boutique with exciting plans and high hopes for the future.

We have worked hard to put together a highly-qualified team of professionals, from the most junior sales executive to the senior management. A cosmopolitan culture consisting of people from various cultural, social and professional backgrounds allows us to interact with and accommodate effectively clients with differing backgrounds and expectations. Some of the most respected and highly renowned names in the country provide the backing and support to our company, which lends us the highest level of recognition socially and professionally.

What specific areas does your firm specialise in?

Our reach in global markets is unrivalled in the local markets by providing brokerage accounts for clients to execute their trades. Our coverage includes most geographical and product markets. From simple currency

crosses in the spot market to the complexities of the derivatives market, we deal across the spectrum. The products/markets that we currently offer work on the principle of ‘leveraged trading’ (leverage means trading

with a face value much larger than the amount provided upfront as a deposit/security) and this leads to unmatchable rates of returns.

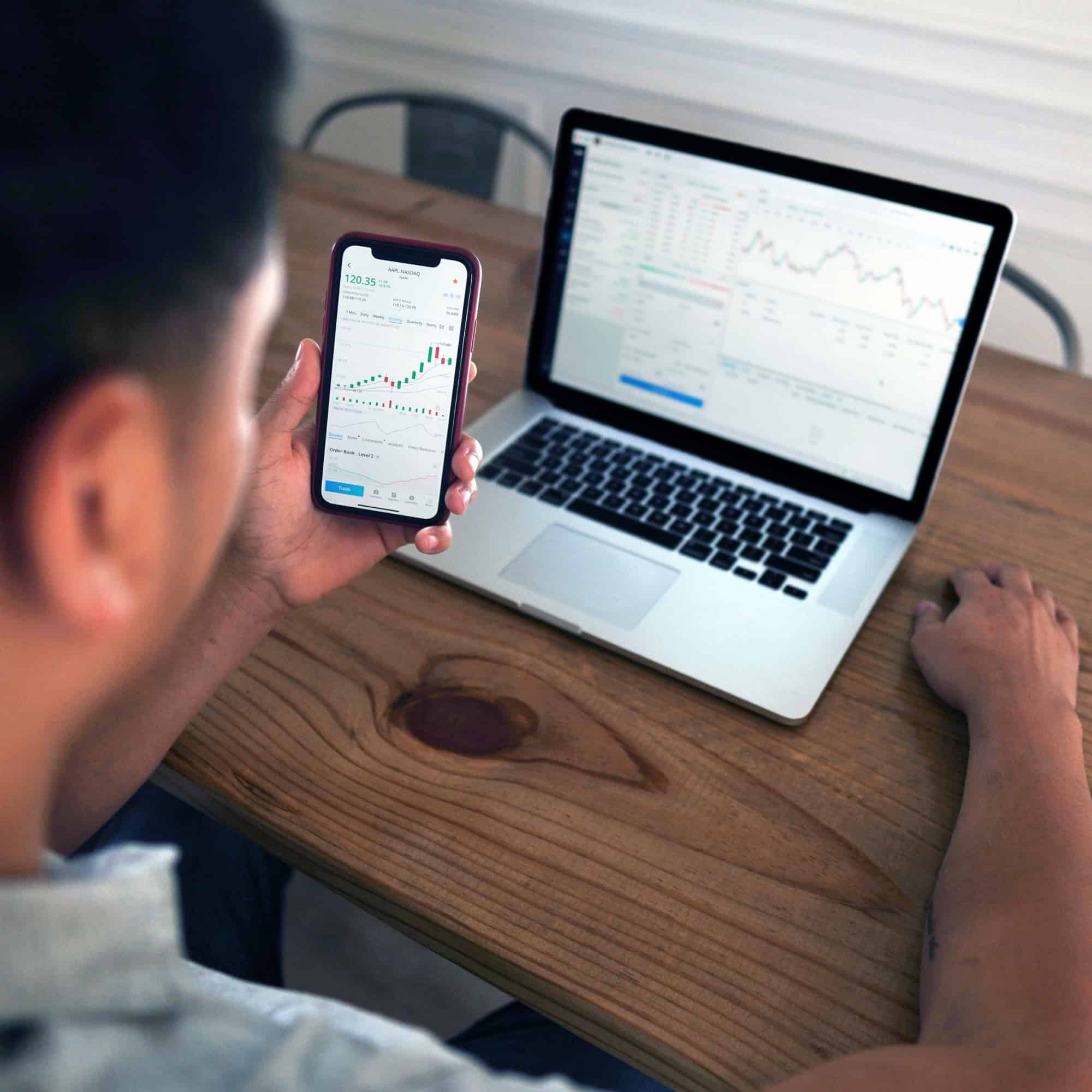

Whatever and wherever clients want to trade, our trading platforms offer unparalleled access to the most liquid financial markets in the world. Online and mobile trading services ensure that you are never more than a click or two away from the client’s next trade.

How does your firm stand out from the crowd in these competitive times?

We are continuously working on developing our IT infrastructure 24/7, we have a specialised IT team of about 15 individuals from various IT backgrounds, all of whom work nonstop to improve and introduce new products to our clients. In the world of finance, IT is crucial to ensure that we can offer services to clients and meet their expectations. We have recently launched our new client onboarding and management platform, called ‘Private Cabinet’ which has improved the effectiveness and speed of client onboarding on a real-time basis.

Hence clients can open up an account online from anywhere in the world, and have it approved in real time and fund their account in real time 24 hours a day, 7 days a week. This has proved to be very successful with many of our clients who come from a variety backgrounds and cultures, since our ‘Private Cabinet’ product is available in several languages. Through this product, our clients can also open real-time sub accounts, carry out internal transfers (real-time) and perform withdrawals and funding. Clients can also try out our ‘Private Cabinet’ by visiting my.swissfs.com (which is mobile friendly and we will soon be launching an app on smart phones platforms, but trading platforms are already available as an app). Technology is therefore our backbone and it as what we work on to give us a competitive edge against others in the market.

How does it feel to have won the award Asset Manager of the Year 2016?

It feels great to have been nominated, and indeed to win this prestigious award! This will give the whole team here much motivation to work even harder and to achieve other awards too. The asset management side of the business here is a fairly new division, because our core focus and strength is on providing clients that want to trade international markets with a brokerage account, and we have provided such a platform for over 15 years. While this had been the firm’s core focus, a few years ago, we started received queries from existing and new clients asking about managed accounts, because they did not have the time to trade on their own or the experience to do so.

How is your company performing at present?

The company is currently in its growth stage and we are expanding to other countries and regions, indeed we are really excited about our expansion progress and we will soon open up two new offices in Saudi Arabia, in Riyadh and Jeddah. On a personal level, my focus is on leading the expansion strategy that has been approved by the board here.

Can you tell me about your own role in the firm as CEO, and the reputation you have gained for providing your clients innovative and successful money management and advisory services?

I am currently the CEO of Swiss International Financial Brokerage Co, having been a founder of the company. Since its inception in 2001, I have worked in all the departments from back office to sales and so on. As the CEO, my overall focus is on the achieving the goals set by the board, whilst at the same time achieving full client satisfaction.

As for providing our clients with innovative new products, we recently launched our Emerald Fund Managed Account Program in 2016. It has proved to be an instant hit with our clients. Having achieving above average returns, whilst at the same time reducing the risk and overall exposure. The program is managed by one of our expert fund managers, who has over 22 years’ experience as a trader.

Can you provide some more insight into the Emerald Fund Managed Account Program?

Emerald Currency Fund offers investors the opportunity to invest directly in the FX Market and potentially benefit when this decreases or increases in value, relative to others. ECF is actively managed on a day-to-day basis and may hold long and short positions in up to twenty currency pairs. The fund is a combination of long-term trend trading and day trading, based on intraday volatility. ECF team has been testing different trading strategies for years and has built the model that consists of our best strategies, which combine long and short term trading.

We have a dedicated trading team who work around the clock – monitoring our trades, positions and model and adjust parameters – based on the expectation, news or any possible shock to market. Moreover, we collaborate with a team of analysts that are feeding our trading desk with exclusive research and potential moves in the currency market, based on fundamentals.

What role the staff play in the success of your company?

First of all, we are proud of our people, and secondly the technology we use. I believe that one does not work without the other. Indeed, it is our people who create growth, builds value and the overall growth that we have achieved. Our staff come from a variety of different cultures, something that brings more tolerance and understanding of each other, because the staff spend more time with colleagues their families at times. We are therefore proud of the firm’s culture and are continuously working on improving the human capital aspect of our work.

What challenges and opportunities do you and your company face in the future?

Swiss International Financial Brokerage’s most important challenge is always working around the clock to beat our current technology and outpace the market with new and exciting developments. Our second challenge is that along with our expansion into new markets, we have had to work with new regulations that are sometimes more like a barrier to entry into such new markets. As for opportunities in the future, with our expansion into new markets we are working to turn the firm into a publicly listed company that the employees can have a percentage ownership into the company that they helped to build, hence working harder!

Is there anything you would like to add?

Just a reminder to our readers is that Swiss Finance is not just an asset management company, but it is also a finance boutique. The company is actually a brokerage house with an asset management department. Hence, we essentially provide a one-stop-shop to all our financial needs and requirements. I would be always more than happy to be answer any questions your readers may have and they can get in touch at any time by using the contact information below.

Company: SWISS INTL. FINANCIAL BROKERAGE CO. K.S.C.C.

Name: Ahmad Shibley

Email: [email protected]

Web Address: www.swissfs.com

Telephone: +965-22020490