Defending your hard-earned money from fraudsters isn’t an optional task, but a modern necessity. With criminals continuously devising new ways to swindle you, it’s crucial to recognize the red flags of financial fraud ASAP.

With that in mind, let’s look at the top signs of potential wrongdoing in your accounts, giving you the means to defend yourself as a result.

Unusual Account Activity: The First Indicator of Trouble

It’s vitally important to monitor your bank and credit accounts for unfamiliar transactions. Unexpected withdrawals, purchases in strange locations, or a sudden increase in activity can be immediate indicators of financial fraud.

You wouldn’t want to have to call on attorneys handling fourth-degree crimes to back you up if you fall victim to this type of fraud. So maintain vigilant oversight of your accounts, and you can spot issues emerging and sort them quickly.

Luckily, most banks have automated systems in place to pick up on unusual account activity, but sometimes these can be overzealous and block legitimate transactions. As such it’s better to rely on your own manual checks, in addition to the protections offered by your provider.

Unexpected Contact from Financial Institutions: Be Wary of Phishing Attempts

Whether it’s through a phone call, email, or text message, receiving an unsolicited communication from a financial institution can be cause for alarm. Fraudsters often disguise themselves as representatives of banks or credit card companies to trick you into revealing your personal information. This practice is known as phishing, and can cost individuals and companies big.

You may receive an email asking you to update your account credentials due to ‘suspicious activity.’ Or perhaps a caller might claim they’re calling about unauthorized transactions and want to verify your details for ‘security purposes’. These tricks are designed to exploit panic and urgency.

To protect yourself, never give out sensitive information until you’ve confirmed the requester’s identity independently. If anything makes you nervous about an incoming communication purportedly from your bank or other financial entity, trust that instinct! Disconnect immediately then reach out directly using contact details provided on their official website.

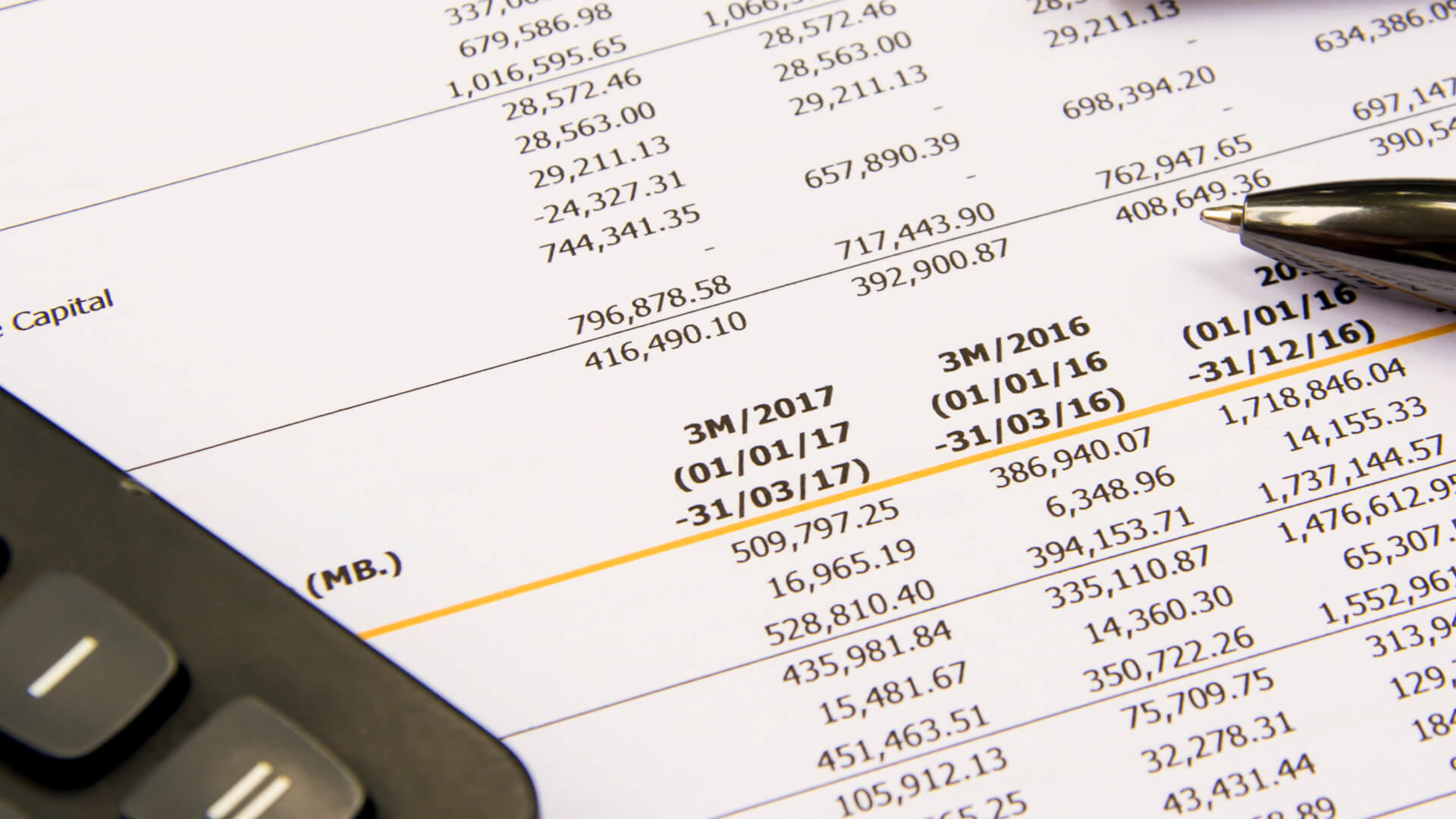

Changes in Your Credit Report: A Silent Alarm Bell

While combing through your credit report might seem tedious, it’s worth doing to prevent financial fraud. After all, the details buried within could indicate whether you’ve become a victim of identity theft or other foul play.

For instance, spotting unrequested hard inquiries on your report indicates someone is attempting to open accounts under your name. Similarly, unrecognized debts surfacing can suggest that fraudsters have successfully opened new lines of credit using your personal information.

So make it a habit to review your report regularly and challenge any discrepancies promptly. Some of the top services allow you access to free annual reports, so take advantage of this.

Receiving Goods or Services You Didn’t Order: More Than Just a Mix-Up

One type of fraud often overlooked is when you start receiving goods, services, bills, or even thank-you emails for purchases that you didn’t make. In some cases, it could be a simple case of mistaken identity. But sometimes these unexpected deliveries can indicate something far more sinister.

Fraudsters might use your card information to test the waters with small transactions before launching into high-ticket items. Or they may redirect their online shopping to your address accidentally because many e-commerce sites auto-fill personal details during checkout.

If an unfamiliar parcel arrives on your doorstep, don’t just ignore it! Contact the retailer directly and review all recent account activities thoroughly.

The Bottom Line

It’s better to be safe than sorry when dealing with potential financial fraud, so engage promptly with any signs of mischief. Now you know what to look out for, you stand a better chance of staying safe.