There is a financial inequality gap between men and women in developing countries and their economies and there has been no sign of improvements in recent years. There is no discernable gender gap in high-income economies.

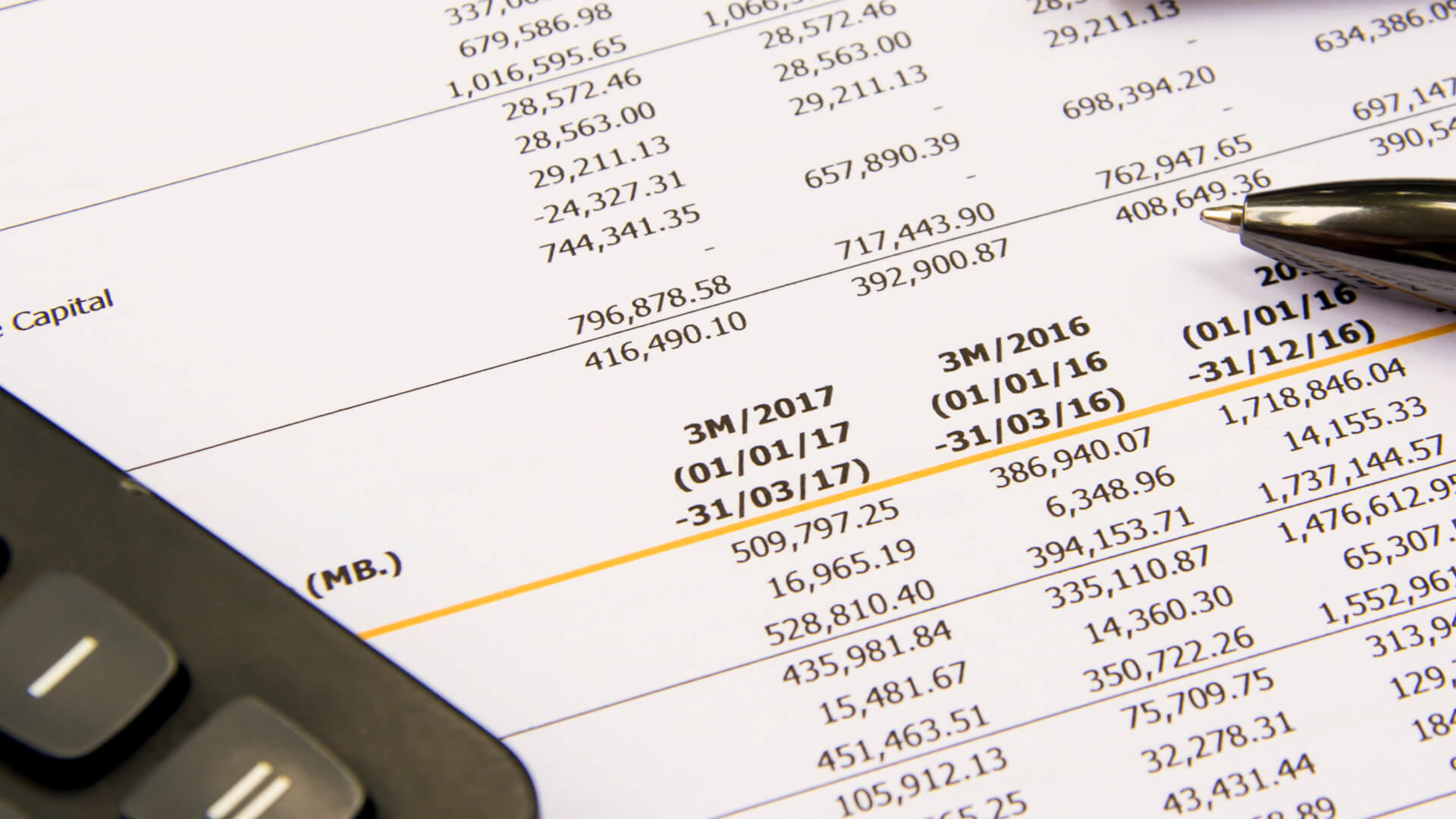

69% of adults. Which is a total of 3.8 billion people around the world have a bank account or mobile money provider. This number has increased by 7% in the last 5 years.

About 1.2 billion adults have obtained some sort of formal financial account since 2011, when the rate of financial inclusion was just 51%.

However, 1.7 billion people around the world remain outside of the formal financial system.

In developing countries, the gender gap in financial inclusion between men and women has stalled at nine percentage points. FairPlanet researched further into the current situation.

When governments deposit social welfare payments directly into women’s digital bank accounts it can empower their decision-making at home.

Research suggests that when women have more financial autonomy, spending in the home tends to be reprioritized. With factors such as the interest of families and children. It can also boost labour force participation among women.

The gap is large in the Middle East and North Africa: 35% of women compared with 52% of men, have access to some type of financial account.

Beyond labor force participation, women face an array of problems and obstacles to getting financial services, including discriminatory laws and conservative social norms.

Simple accounts accessed through mobile phones might help thwart some of these barriers.

Mobile money accounts are often easier to open than traditional bank accounts and they have the added benefit of allowing women to transact from the safety and comfort of their homes.

Mobile technology and money accounts may help to close the gender gap when it comes to financial equality. However, like anything, further research and data is needed to truly predict what the future holds.