Category: Issues

Showing page 1 of 3 with 83 matching results.

As we make our way through Q1, 2024 is looking to be a landmark year for the world of finance, with various significant changes and developments projected ahead. Among these, AI will continue to have a pivotal influence, whether in revolutionising customer service, reshaping financial tools, or streamlining back-office operations.

As the end of 2023 nears, it comes time to reflect on the successes and challenges of the past 12 months. While ongoing hurdles include fee pressure, the cost of living crisis, and inflation, there is also a lot to be feeling really positive about in the world of finance.

Playing a fundamental role in ensuring cyber safety is our cover feature, Cameron Brown, a director at Big 4 accounting and consultancy firm, Deloitte, who is leading on its work in cybersecurity. In his own words, Cameron shares with us how crucial it is to take cybersecurity seriously and the work that his department does to protect businesses and individuals from the dangers of cybercrime.

Six months into 2023, the shift to a digital world is showing no signs of slowing down. A cashless society is on the way to becoming a reality, with millennials and generation z placing great importance on making quick, convenient digital payments. Even older generations have begun exploring the benefits of electronic payments.

The businesses that are succeeding in this evolving market are the ones who make the most out of tech, who create new business models, and who put their customers at the centre of everything they do. It’s all about knowing what’s coming and being able to adapt to a changing world.

This year we have seen already seen all kinds of weather, news, developments, and companies come and go. Pushing further into this year, we look for inspiration everywhere as we head towards spring. Here we have a varied selection of driven businesses tirelessly searching for new ways to succeed.

Though the economic impact of COVID-19 cannot be overestimated, there are signs of optimism to be found on the financial landscape. After the rather swift baptism of fire we all experienced in March – as we rushed to strengthen digital infrastructure – we’ve settled a bit into this new socially distanced world we find ourselves in.

It’s been an odd couple of weeks. Following a terrible (to put it lightly) few days for global stock markets, the last 24 hours has seen a dramatic rallying turnaround. While we’re probably not at all out of hot water when it comes to the economic impact of COVID-19, recovery in any form is certainly a pleasant sight. But, as always, we step gingerly onward, wary of further disruption. Ultimately, uncertainty and risk are just a natural part of the wealth and finance landscape.

Every issue we endeavour to provide fund managers, institutional and private investors with the very latest industry news in the traditional and alternative investment landscapes. Putting aside, at least for the time being, the tumultuous stock markets and dire warnings from financial experts on the topic of an ‘imminent’ global recession, we are focusing – as ever- on more optimistic shores.

Welcome to the second issue of Wealth & Finance International Magazine for 2019. As always, we are dedicated to providing fund managers, institutional and private investors with the very latest industry news in the traditional and alternative investment landscapes. This issue we are looking forwards. More specifically, at how to secure the future, whatever the coming years may bring.

Welcome to the first issue of Wealth & Finance International Magazine for 2019. As always, we are dedicated to providing fund managers, institutional and private investors with the very latest industry news in the traditional and alternative investment landscapes. Though the New Year typically heralds in a new start and fresh beginnings, the wealth and finance industries look towards strengthening their position for the challenges that lie ahead. Continuing economic uncertainty partnered with Brexit’s looming presence are, in all likelihood, going to bring renewed volatility to the world’s stock markets.

Welcome to the twelfth issue of Wealth & Finance International Magazine, which is dedicated to providing fund managers, institutional and private investors with the very latest industry news in the traditional and alternative investment landscapes. This month we take a look and investment and wealth managers who have, simply, done things differently than their peers and competitors. In this challenging economic environment, doing things differently is certainly a risk – avoiding the well-worn path in favour of new pastures. Yet, for the firms included in this month’s issue, these risks have yielded strong results for their clients and company alike.

This month we have a keen focus on wealth management firms from all corners of the globe. October proved a challenging and incredibly volatile month for stocks on the back of an otherwise stable third quarter, though markets have – for the most part – have since recovered. Regardless of what the rest of the month holds in store, we wanted to celebrate the work of wealth managers worldwide who have achieved exceptional results for their clients, despite difficulty and uncertainty.

This month’s issue looks towards the future, as we explore the ways that technology will shape the investment and finance landscapes. In many ways, the investment industry has undergone a schism, dividing the market in two: on one side, the traditionalists, who advocate for human-driven expertise and management. On the other, the futurists, who believe that the future of finance lies in AI, algorithms and machine learning.

Welcome to the ninth issue of Wealth & Finance International Magazine, which is dedicated to providing fund managers, institutional and private investors with the very latest industry news in the traditional and alternative investment landscapes.

Welcome to the eighth issue of Wealth & Finance International Magazine, which is dedicated to providing fund managers, institutional and private investors from around the globe with the very latest industry news in the traditional and alternative investment landscapes. Gracing the cover of this month’s issue is Azizi Bank. As the largest commercial bank in […]

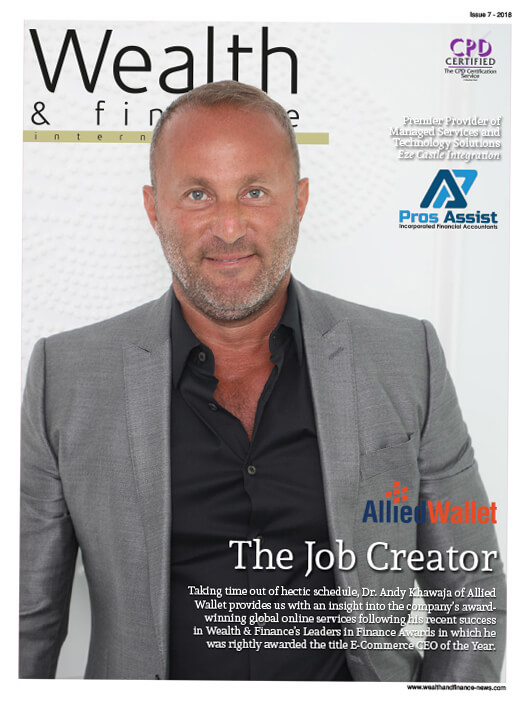

In this issue, we cast a light to Allied Wallet who graces the front cover of this edition. Taking time out of hectic schedule, Dr. Andy Khawaja of Allied Wallet provides us with an insight into the company’s award-winning global online services following his recent success in Wealth & Finance’s Leaders in Finance Awards in which he was rightly awarded the title E-Commerce CEO of the Year.

In this issue, we take a closer look at Caye International Bank. The firm provides stability, confidentiality and higher returns for their customers and clients. Recently, we spoke with Caye’s Senior Vice President, Luigi Wewege about the Bank, its services and his aspirations moving forward.

In this month’s edition, we discover more about Learn to Trade, which is a forex education and training specialist. The firm offers a range of courses that help people learn about and understand the forex market and the opportunities and risks within it. We recently spoke with their CEO, James Matthews who provided us with an insight into the firm and the exceptional services they provide.

Welcome to the 4th issue of 2018 for Wealth & Finance Magazine, hosting an array of news features, and articles from across both traditional and alternative investment sectors. On the 19th April 2018, the PenFed Foundation announced the launch of its new Veteran Entrepreneur Investment Program (VEIP). Through Foundation contributions and matching funding of up to $1 million from PenFed Credit Union in 2018, the program will: provide veteran-owned start-ups with seed capital to build and grow their businesses, create robust networks and enable the PenFed Foundation to perpetually re-invest returns in future veteran-owned businesses.

In recent news, HALL Structured Finance (HSF) has announced that the company has closed a new first lien loan totalling $35.5 million to finance the construction of The Vantage multifamily high-rise in St. Petersburg, Florida. The property developer is Michigan-based DevMar Development and the project is expected to be completed in September 2019.

Gracing the cover of this month’s edition, is 3E Accounting Pte. Ltd. The company stands out as being one of the leading service providers, especially in Singapore Companies Registration and Corporate Secretarial Services, with its one-stop solution that covers all of its client’s accounting and regulatory requirements. Taking time to discuss with us the firm’s impressive success, is Managing Director, Lawrence Chai who reveals more about the professional team at 3E Accounting, which comprises highly experienced and expert professionals in Singapore’s financial, tax, corporate and regulatory landscape.

In this month’s issue, we discover more about Opilio Recruitment. The firm was established in 2010 and is the go-to digital recruitment agency for global brands and tech start-ups. We spoke to Sheba Karamat as we find out more about this knowledgeable and industry leading firm. Also in this edition, Beckford James are experienced, independent chartered financial planners. We invited Partner & Chartered Financial Planner, Joseph Maguire to provide us with an insight into the company’s success behind the scenes.

In recent news, on the 14th December, Funds affiliated with Apollo Global Management, LLC (together with its consolidated subsidiaries, “Apollo”) announced that they have signed a definitive agreement to acquire Sun Country Airlines, the largest privately-held fully independent airline in the United States, from brothers Marty and Mitch Davis. The transaction, which is subject to regulatory approvals and other customary conditions, is targeted to close during the first quarter of 2018.

Welcome to November issue of Wealth & Finance Magazine, proving you with an insight into the latest industry news across both traditional and alternative investment sectors. Gracing the cover of this month’s issue, we meet Chief Financial Officer (CFO), Seetha Bansil who works on the Executive Management Team at Aspect Enterprise Solutions. AspectCTRM was delivered as the first web-based trade and risk solution 17 years ago. Recently, we profiled the company and Seetha as we look to find out more about her and the company’s success.